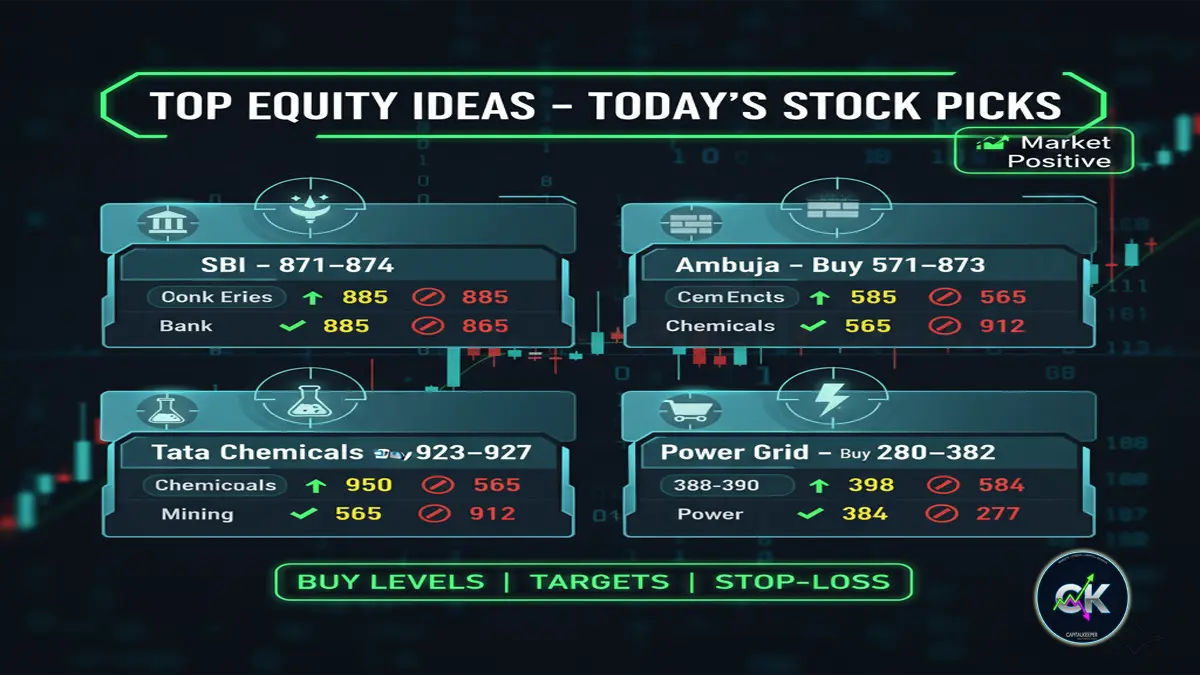

Equity Ideas for 03rd Oct 2025: SBI, Ambuja Cements, Tata Chemicals, Coal India & Power Grid

By CapitalKeeper | Pre Market Opening | Indian Equities | Market Moves That Matter

✅ Equity Ideas for Tommorow: SBI, Ambuja Cements, Tata Chemicals, Coal India & Power Grid

Discover today’s top stock picks — SBI, Ambuja Cements, Tata Chemicals, Coal India, and Power Grid. Get detailed entry levels, targets, stop-loss strategies, and market outlook for short-term traders and investors.

📊 Introduction

As the Indian stock market heads into a new trading session, traders and investors are searching for short-term equity ideas backed by solid technicals and sectoral momentum. Global cues remain stable, domestic flows are supportive, and the market sentiment suggests that selective stocks are positioned for potential upside.

Today’s top 5 equity recommendations are:

- 🏦 SBI – banking sector leader showing resilience.

- 🧱 Ambuja Cements – supported by infra and housing demand.

- ⚗️ Tata Chemicals – benefitting from cyclical chemical uptrend.

- ⛏️ Coal India – stable demand and strong dividend play.

- ⚡ Power Grid – a defensive yet consistent performer.

Each of these stocks comes with entry price, target levels, and stop-loss strategies, ensuring traders have a disciplined roadmap.

🏦 SBI (State Bank of India)

- CMP: ₹873

- VWAP: ₹872.83

- Day Range: ₹870.30 – ₹876.45

- Buy Zone: ₹871 – ₹874

- Target 🎯: ₹885

- Stop-Loss ⛔: ₹865

📈 Analysis

SBI remains a banking bellwether and is crucial in determining Bank Nifty’s momentum. The stock is consolidating around VWAP, showing accumulation near ₹872–874 levels.

With intraday charts signaling higher lows, SBI looks set to test ₹885 in the short term. Banking liquidity, rising credit growth, and strong Q2 earnings expectations are additional catalysts.

Risk-Reward: Entering near ₹872 with a stop at ₹865 gives a risk of ₹7 for a potential reward of ₹12, which is favorable.

🧱 Ambuja Cements

- CMP: ₹572

- VWAP: ₹571.73

- Day Range: ₹570.25 – ₹572.90

- Buy Zone: ₹571 – ₹573

- Target 🎯: ₹585

- Stop-Loss ⛔: ₹565

📈 Analysis

Ambuja Cements has seen strong institutional interest as the infra push and real estate growth continue to drive cement demand. Trading very close to VWAP, the stock signals sideways consolidation with potential breakout.

The ₹565 level acts as a strong base, and if volumes pick up, the stock could rally to ₹585 quickly.

Sector Catalyst: The government’s infrastructure spend and housing demand recovery remain supportive for cement companies.

⚗️ Tata Chemicals

- CMP: ₹925

- VWAP: ₹924.92

- Day Range: ₹913.60 – ₹933.30

- Buy Zone: ₹923 – ₹927

- Target 🎯: ₹950

- Stop-Loss ⛔: ₹912

📈 Analysis

Tata Chemicals has been in focus with its specialty chemical expansion and steady demand in the domestic and export markets.

The stock has created a strong support base around ₹912–915. With CMP above VWAP and higher intraday lows, it signals strength.

Risk-Reward: Buying between ₹923–927 for a target of ₹950 provides a strong setup with controlled downside.

Technical View: A move above ₹933 could accelerate momentum, while ₹912 remains a reliable stop-loss.

⛏️ Coal India

- CMP: ₹389.1

- Pre-open Print (09:22 IST): 388.15 – 390.70

- Buy Zone: ₹388 – ₹390

- Target 🎯: ₹398

- Stop-Loss ⛔: ₹384

📈 Analysis

Coal India continues to attract attention as energy demand stays strong. The stock has shown resilience even during volatile sessions, making it a dependable intraday and swing candidate.

The ₹384 level has held as solid support, and traders can use dips around ₹388–389 as a buying opportunity.

Fundamental Backdrop: Coal India’s high dividend yield and strong cash flows make it attractive to long-term investors as well, while traders can capitalize on short-term momentum.

Target Outlook: The immediate resistance lies at ₹398, which, if crossed, can open the door for ₹405 in extended momentum.

⚡ Power Grid

- CMP: ₹281.3

- VWAP: ₹281.25

- Day Range: ₹280.30 – ₹282.45

- Buy Zone: ₹280 – ₹282

- Target 🎯: ₹289

- Stop-Loss ⛔: ₹277

📈 Analysis

Power Grid has emerged as a defensive bet in the utilities space. The stock often performs well during uncertain phases in the market.

Currently trading at VWAP, the stock has strong support around ₹277. A push above ₹282 could set the tone for ₹289.

Sector Catalyst: With India’s push towards renewable integration and power infrastructure upgrades, Power Grid remains a long-term steady compounder while offering short-term trading opportunities.

📌 Conclusion

Today’s Top Equity Ideas provide a mix of banking, infra, chemicals, energy, and utilities exposure. Traders can diversify risk while seeking short-term opportunities.

- SBI → Strong banking momentum with upside potential to ₹885.

- Ambuja Cements → Supported by infra demand; looks set for ₹585.

- Tata Chemicals → Riding the chemical uptrend; eyeing ₹950.

- Coal India → Defensive energy play, target ₹398.

- Power Grid → Utilities stability; good bet towards ₹289.

Trading Strategy: Stick to VWAP-based entries, use stop-losses strictly, and book profits at defined targets.

🔑 Key Takeaways for Traders

- Always align trades with sector momentum (banking, infra, chemicals).

- VWAP remains a powerful intraday guide for entries.

- Risk management is essential — respect stop-losses.

- Defensive plays like Coal India & Power Grid balance aggressive bets like SBI or Tata Chemicals.

📢 Pro Tip

Keep monitoring Nifty & Bank Nifty trends, as large-cap stocks like SBI and Power Grid are heavily index-linked. Intraday volatility in the broader indices can directly impact these setups.

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

Subscribe Now , Join Telegram the Crypto Capital Club, Get Free Crypto Updates

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply