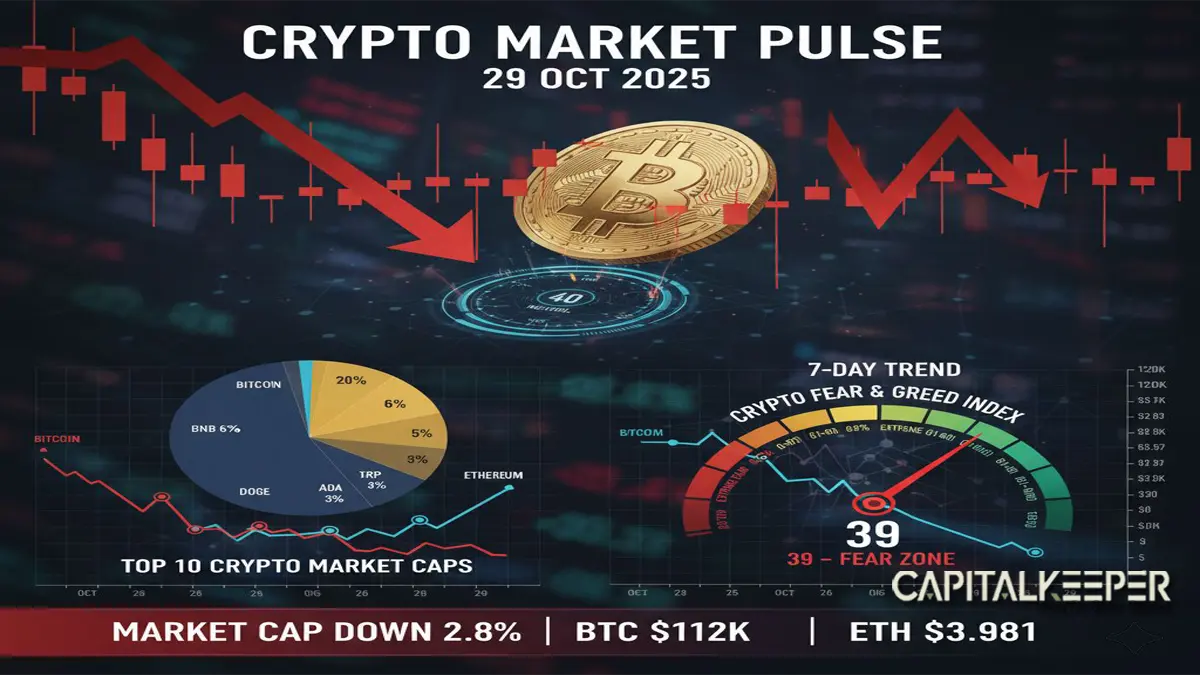

Crypto Market Pulse 03 Oct 2025 | Bitcoin Consolidates, Altcoins Show Strong Upside

By CapitalKeeper | Crypto Market Pulse | Crypto Capital | Market Moves That Matter

Stay updated with the latest crypto market trends on 03 October 2025. Bitcoin stabilizes above $120K while Ethereum, BNB, and Solana lead altcoin gains. Detailed analysis, price outlook, and investor insights.

Crypto Market Pulse – 03 October 2025 | Bitcoin Steadies, Altcoins Gain Momentum

📌 Market Overview – 03 October 2025

The crypto market remains resilient as we enter October 2025, with Bitcoin (BTC) holding firm above the $120,000 mark, while several altcoins outperform with strong double-digit weekly gains. Despite global market uncertainties, investors continue to display strong confidence in the digital asset ecosystem.

The total market capitalization of cryptocurrencies has climbed above $3.5 trillion, reflecting renewed inflows from both institutional and retail participants. The focus remains on Ethereum’s post-upgrade ecosystem, Binance Coin’s surge in DeFi adoption, and Solana’s growing relevance in NFT + gaming projects.

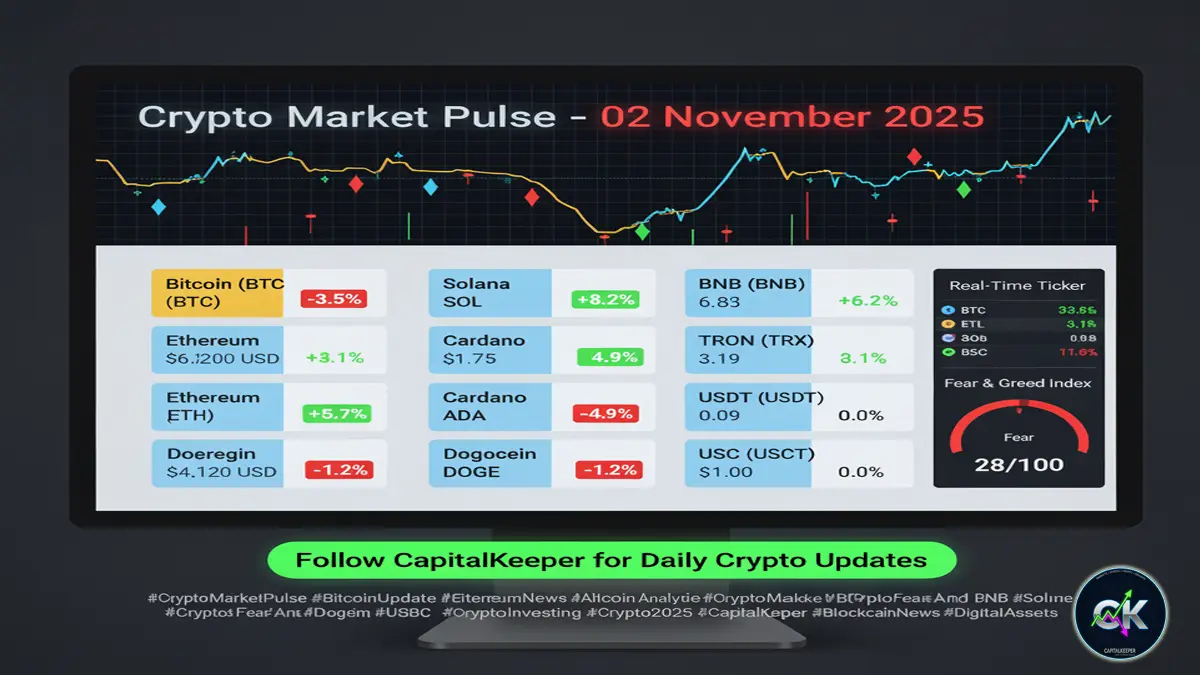

🔥 Top Cryptos by Market Performance (03/10/2025)

1. Bitcoin (BTC) – $120,556.31 (+0.78%)

Bitcoin continues to consolidate above $120K, acting as the ultimate anchor of market sentiment. While volatility has decreased compared to August–September swings, BTC’s stability is boosting investor confidence.

- Market Cap: $2.40T

- Key Support Levels: $118,000 – $119,200

- Resistance Zone: $123,500 – $125,000

- Investor Insight: Institutional buying through ETFs and corporate treasuries has created a strong base, with analysts expecting BTC to test $130K before mid-October.

2. Ethereum (ETH) – $4,479.91 (+1.72%)

Ethereum remains the backbone of Web3. Post its successful scalability upgrade earlier this year, ETH continues to attract massive volumes from DeFi, NFT, and Layer-2 protocols.

- Market Cap: $540.84B

- Trend: Bullish, as ETH trades close to 2-year highs.

- Next Targets: $4,800 short-term, $5,200 medium-term.

- Investor Insight: With staking yields stabilizing and gas fees significantly reduced, ETH is becoming an attractive long-term hold.

3. XRP – $3.02 (+1.63%)

XRP continues its steady upward trajectory as cross-border payment adoption expands. Regulatory clarity in the US and Asia-Pacific has significantly boosted investor confidence.

- Market Cap: $181.06B

- Key Levels: $2.80 support, $3.20 resistance.

- Outlook: XRP’s integration with financial institutions gives it long-term growth potential.

4. Binance Coin (BNB) – $1,131.83 (+7.04%)

BNB has emerged as October’s breakout performer, gaining over 7% in the last 24 hours. Strong DeFi adoption and ecosystem growth on BNB Chain are driving this rally.

- Market Cap: $157.46B

- Key Resistance: $1,200

- Investor Insight: If momentum continues, BNB could retest $1,300 levels in the coming week.

5. Solana (SOL) – $230.20 (+1.68%)

Solana is regaining its position as a top smart-contract platform, especially in NFTs, gaming, and metaverse projects. The chain has recorded an increase in active wallets and DEX volumes.

- Market Cap: $125.45B

- Support Level: $220

- Target Zone: $250–$270

- Outlook: SOL is one of the top contenders for Q4 performance if current network activity sustains.

6. Dogecoin (DOGE) – $0.2566 (+0.77%)

Meme coins continue to surprise. DOGE, backed by community hype and occasional high-profile endorsements, has shown consistent upward momentum.

- Market Cap: $38.78B

- Trend: Sideways to bullish.

- Key Levels: $0.25 (support), $0.30 (resistance).

7. Cardano (ADA) – $0.8573 (+0.61%)

ADA is slowly building momentum as its Hydra scaling upgrade gains adoption. However, price movement remains relatively muted compared to peers.

- Market Cap: $30.66B

- Investor Watch: Accumulation at current levels could set the stage for a stronger Q4 rally.

8. TRON (TRX) – $0.3428 (+0.30%)

TRX continues to be one of the most consistent performers in the stablecoin settlement ecosystem, maintaining steady growth.

- Market Cap: $32.46B

- Trend: Steady with limited volatility.

9. Stablecoins (USDT & USDC)

Both Tether (USDT) and USD Coin (USDC) remain stable at $1 peg, though fluctuations in liquidity have been noticed. Market participants continue to rely on stablecoins for trading and DeFi exposure.

📊 Technical Market Sentiment – 03 October 2025

- RSI Levels: Most top-10 cryptos remain in a neutral-to-bullish RSI zone (55–65), indicating steady momentum.

- MACD Indicators: BTC and ETH show bullish crossovers, suggesting upside continuation.

- Market Liquidity: Higher inflows in altcoins compared to Bitcoin dominance, indicating risk-on sentiment among investors.

🌍 Global & Macro Cues Impacting Crypto

- US Federal Reserve Policy: Continued stance on rate cuts is fueling demand for high-risk assets like crypto.

- Institutional Inflows: Spot Bitcoin ETFs and ETH staking funds are witnessing heavy inflows.

- Regulatory Updates: Asia-Pacific markets (Singapore, Japan, India) are moving toward friendlier frameworks, enhancing adoption.

- Geopolitical Risks: Investors are hedging against global uncertainty by diversifying into digital assets.

🚀 Outlook for October 2025

- Bitcoin (BTC): Likely to remain in the $118K–$125K range before testing new highs.

- Ethereum (ETH): Strong candidate to cross $5K in the near term.

- Altcoins: Expect BNB, SOL, and XRP to outperform if current momentum sustains.

- Meme Coins: DOGE and SHIB may see volatility but remain speculative plays.

💡 CapitalKeeper Insight

The current market structure shows crypto resilience against macro headwinds, with a shift toward altcoin leadership in October. For long-term investors, BTC and ETH remain the safest bets, while BNB, SOL, and XRP offer attractive growth opportunities.

Short-term traders should watch key resistance levels, as breakouts could fuel quick gains, particularly in BNB and Solana.

✅ Conclusion

The crypto market on 03 October 2025 reflects stability in Bitcoin and momentum in altcoins, signaling a risk-on phase for investors. With institutional inflows, strong DeFi activity, and regulatory clarity improving globally, the long-term outlook remains bullish.

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

Subscribe Now , Join Telegram the Crypto Capital Club, Get Free Crypto Updates

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply