Crypto Market Pulse 04 Oct 2025 | Bitcoin Steady at $121K, Altcoins Cool Off After Rally

By CapitalKeeper | Crypto Market Pulse | Crypto Capital | Market Moves That Matter

Explore the latest crypto market trends for 04 October 2025. Bitcoin stays resilient near $121,800, while Ethereum, BNB, and Solana see mild pullbacks. A detailed market analysis with altcoin insights and investor outlook.

🪙 Crypto Market Pulse – 04 October 2025 | Bitcoin Holds $121K, Market Consolidates Ahead of Next Leg

🌍 Market Snapshot – 04 October 2025

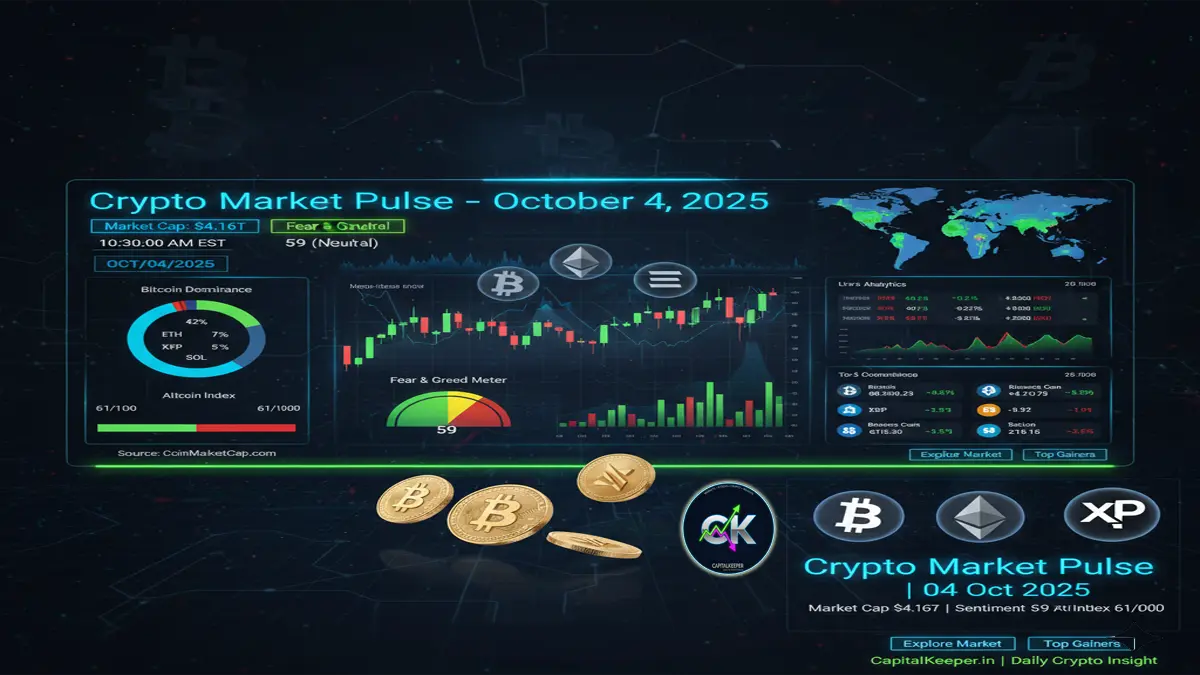

After a strong start to October, the global crypto market entered a mild consolidation phase today. The overall market capitalization stands at $4.16 trillion, slightly down 0.30% in the last 24 hours.

The CMC20 Index (tracking top-performing assets) dipped by 0.58%, reflecting minor corrections in leading altcoins after recent multi-day rallies. Meanwhile, the Altcoin Index at 61/100 indicates moderate momentum and room for accumulation.

The Fear & Greed Index stands at 59 (Greed Zone) — a sign that investor sentiment remains confident despite minor red ticks across the charts.

📊 Top Cryptocurrency Prices (as of 04/10/2025)

| Rank | Crypto | Price | 24h Change | Market Cap |

|---|---|---|---|---|

| 1 | Bitcoin (BTC) | $121,801.46 | 🔻0.30% | $2.43T |

| 2 | Ethereum (ETH) | $4,466.48 | 🔻0.46% | $539.29B |

| 3 | XRP (XRP) | $2.94 | 🔻3.01% | $176.50B |

| 4 | Tether (USDT) | $1.00 | 🟢0.01% | $176.32B |

| 5 | Binance Coin (BNB) | $1,147.73 | 🟢0.31% | $159.88B |

| 6 | Solana (SOL) | $226.96 | 🔻1.75% | $123.71B |

| 7 | USD Coin (USDC) | $0.9997 | 🟢0.01% | $75.35B |

| 8 | Dogecoin (DOGE) | $0.2492 | 🔻2.80% | $37.69B |

| 9 | TRON (TRX) | $0.3399 | 🔻1.06% | $32.18B |

| 10 | Cardano (ADA) | $0.8376 | 🔻2.76% | $29.90B |

💹 Bitcoin (BTC) – Stable Yet Watching Resistance

Bitcoin’s current price at $121,801 shows a minor dip of 0.30%, marking a pause after last week’s push beyond the $120K mark.

However, the overall momentum remains constructive, with bulls defending the $121K zone effectively.

- Market Cap: $2.43 Trillion

- Support Levels: $120,000 and $118,500

- Resistance Levels: $123,500 and $126,000

Outlook:

Bitcoin’s strong institutional inflows through ETFs and consistent demand from corporate treasuries remain the key pillars of support. Technical indicators such as the RSI (60) and MACD showing flattening momentum suggest short-term consolidation before the next breakout attempt.

CapitalKeeper View:

“BTC is entering a healthy cooldown after a vertical rally. As long as $120K holds, the trend remains bullish.”

⚙️ Ethereum (ETH) – Slight Cooling After a Powerful Quarter

Ethereum is trading at $4,466, down 0.46%, cooling off after its impressive September rally. The ETH/BTC ratio remains steady, indicating capital rotation but not weakness.

- Market Cap: $539.29 Billion

- Support: $4,400

- Resistance: $4,600 / $4,800

Key Development:

Ethereum’s Layer-2 ecosystem expansion continues to attract liquidity, especially into projects on Arbitrum and Base. Gas fees remain low, strengthening network usability.

Investor Sentiment:

ETH staking deposits remain consistent, with more than 28 million ETH locked, highlighting long-term confidence.

🌊 XRP (Ripple) – Faces Profit Booking

XRP slipped 3.01% to $2.94, marking one of the day’s sharpest declines among top coins. The correction follows an impressive 15% weekly rise, as traders booked profits.

- Market Cap: $176.5B

- Support: $2.80

- Resistance: $3.10

Catalyst:

Regulatory clarity in multiple jurisdictions continues to strengthen XRP’s role in cross-border payments, but near-term overbought conditions triggered mild selling pressure.

Outlook:

Short-term dips likely to attract buyers near $2.80 for a rebound toward $3.20.

🪙 Binance Coin (BNB) – Steady Climb Continues

BNB remains among the few gainers today, up 0.31%, trading at $1,147.73. The coin’s strength stems from continuous growth in the BNB Chain DeFi ecosystem, which is witnessing a surge in active addresses and total value locked (TVL).

- Market Cap: $159.88B

- Trend: Strong bullish momentum intact.

- Short-Term Target: $1,200

- Support: $1,100

CapitalKeeper Note:

BNB continues to outperform major altcoins due to consistent on-chain activity and real-world use cases.

🌐 Solana (SOL) – Cooling After Strong Rally

After a stellar run earlier this week, Solana dropped 1.75% to $226.96, mirroring a sector-wide cool-off in altcoins.

- Market Cap: $123.71B

- Support: $220

- Resistance: $240

Ecosystem Watch:

Solana remains dominant in NFT and gaming activity, with increasing DEX volume suggesting strong community engagement.

🪙 Altcoin Recap: Mixed Momentum

- Dogecoin (DOGE): Down 2.80%, at $0.249, reflecting volatility typical of meme coins.

- Cardano (ADA): Lost 2.76%, currently at $0.83, with traders eyeing next week’s Vasil upgrade patch.

- TRON (TRX): Down 1.06%, holding steady due to stablecoin transaction demand.

Stablecoins (USDT & USDC): Both maintained peg stability around $1.00, showing robust liquidity in DeFi protocols.

🧭 Technical Snapshot

- BTC RSI: 60 (neutral, awaiting breakout)

- ETH RSI: 58 (slightly cooling)

- Altcoin RSI Range: 55–65 (healthy zone)

- Market Breadth: 42% of coins trading above 20-day moving average (moderate strength).

Volatility Index: Slightly compressed, indicating a period of consolidation — typically a precursor to a sharp move in coming sessions.

🌎 Macro & Sentiment Drivers

- Global Markets: Risk-on sentiment moderates after strong U.S. job data, limiting liquidity flows into crypto.

- Regulation: Positive updates from the EU’s MiCA framework continue to enhance investor trust.

- Adoption: Japan and South Korea report surging institutional participation in ETH and BTC futures.

- DeFi Revival: Total DeFi TVL rose 1.2% week-over-week, showing sustained investor engagement.

💬 CapitalKeeper Strategic View

October’s crypto setup resembles a “mid-rally breather” — a healthy phase for accumulation before the next upward leg.

- BTC remains the anchor of confidence, consolidating firmly above key psychological levels.

- ETH and BNB continue to lead the smart-contract ecosystem.

- SOL, XRP, and ADA are likely to witness renewed buying once short-term profit booking subsides.

Top Picks for the Week:

- BTC (Accumulation near $121K)

- ETH (Targets $4,800)

- BNB (Likely to cross $1,200 soon)

- SOL (Buy zone $220–$225 range)

🔮 Outlook for the Coming Week

| Segment | Expectation | Key Trigger |

|---|---|---|

| Bitcoin | Sideways to bullish | ETF inflows & U.S. Fed commentary |

| Ethereum | Positive bias | L2 ecosystem expansion |

| Altcoins | Mixed performance | Rotation between mid-caps |

| Meme Coins | Speculative & volatile | Social sentiment-driven |

| DeFi Tokens | Gradual accumulation | Rising on-chain TVL |

✅ Conclusion

The Crypto Market Pulse – 04 October 2025 signals a calm after the storm.

Markets are catching their breath following a multi-week rally. Bitcoin continues to dominate sentiment above $121K, while altcoins undergo mild corrections — a healthy sign of rotation and consolidation.

As global liquidity stabilizes and on-chain metrics strengthen, the crypto ecosystem remains fundamentally bullish heading into mid-October 2025.

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

Subscribe Now , Join Telegram the Crypto Capital Club, Get Free Crypto Updates

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply