Crypto Market Pulse Today (25th August 2025): Bitcoin, Ethereum, and Altcoins Face Pressure Amid Market Uncertainty

By CapitalKeeper | Crypto Market Pulse | Crypto Capital | Market Moves That Matter

Stay updated with the latest Crypto Market Pulse of 25th August 2025. Bitcoin at $111,003, Ethereum at $4,578, and Solana at $195 face selling pressure. Market analysis, trends, and investor insights inside.

Crypto Market Pulse – 25th August 2025

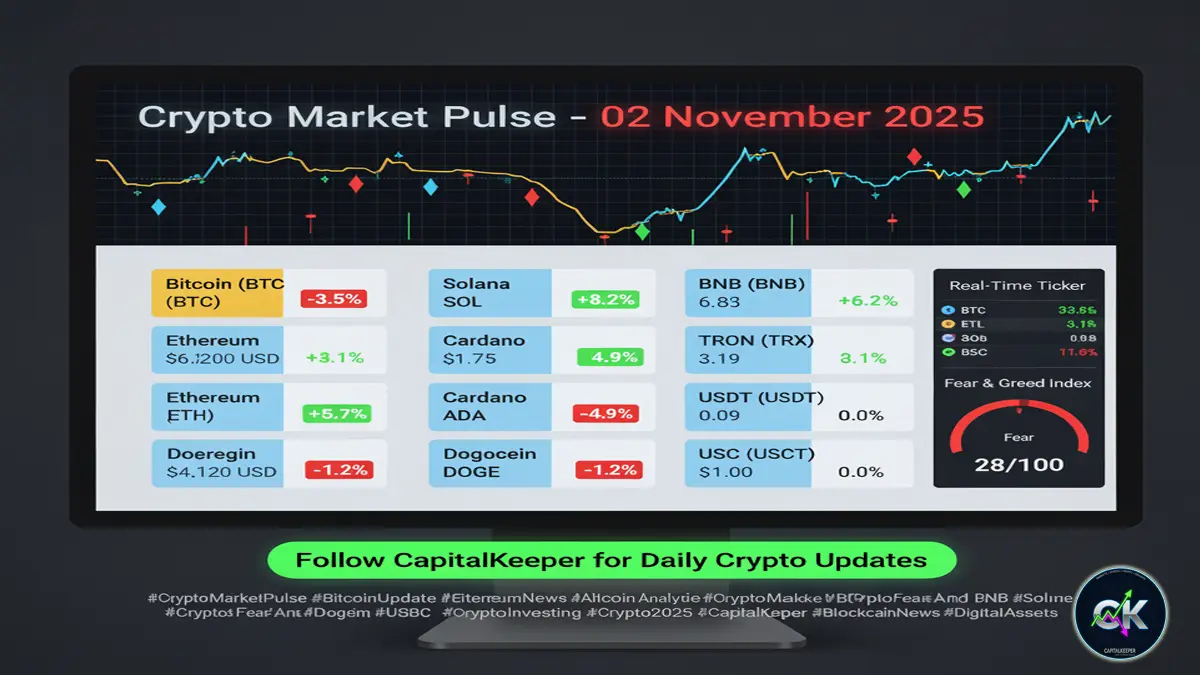

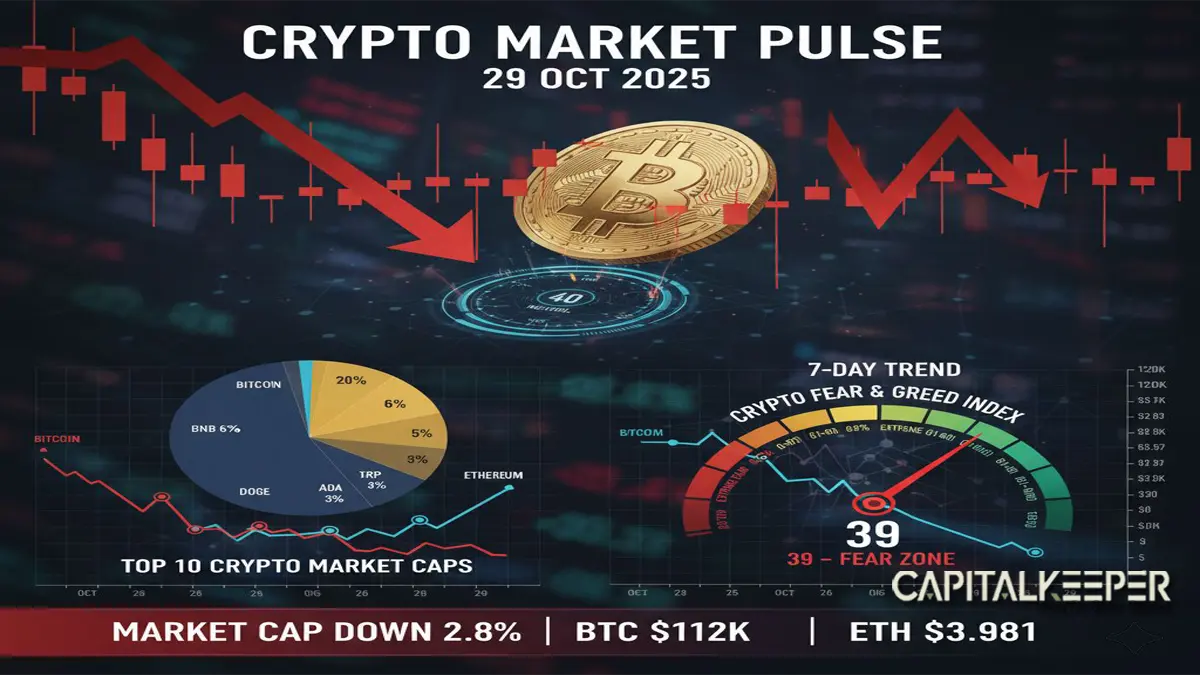

The cryptocurrency market on 25th August 2025 witnessed another volatile trading session, reflecting the ongoing tug-of-war between bullish hopes and bearish pressure. Global crypto market capitalization stood at $3.96 trillion, down by 0.35%, while the CMC100 index dropped 3.17%, signaling broad weakness across major digital assets.

The Altcoin Index came in at 49/100, suggesting neutral sentiment, while the widely tracked Fear & Greed Index was at 53, indicating a cautious but not panic-driven market mood. Traders and long-term investors alike are closely monitoring these indicators, as they shape short-term price action and medium-term positioning.

1. Bitcoin (BTC) – Price at $111,003 (-3.16%)

Bitcoin, the undisputed market leader with a staggering $2.28 trillion market cap, fell by 3.16% over the last 24 hours, closing at $111,003. Despite its long-term bullish outlook, Bitcoin’s short-term momentum appears under pressure as profit booking dominates near the $112,000–115,000 resistance zone.

- Support Levels: $108,500 and $105,000

- Resistance Levels: $112,500 and $118,000

- Investor Outlook: Institutions continue to view Bitcoin as a hedge against inflation, but macroeconomic factors, such as U.S. interest rates and liquidity tightening, have slowed the pace of new inflows.

With the market sentiment hovering around “neutral,” Bitcoin may consolidate before attempting another breakout.

2. Ethereum (ETH) – Price at $4,578 (-3.48%)

Ethereum, the second-largest cryptocurrency with a $576.39 billion market cap, traded at $4,578, declining 3.48%. This pullback comes after ETH tested the $4,700–4,800 resistance zone, where sellers emerged.

- Key Factors Influencing ETH:

- The Ethereum 3.0 upgrade continues to drive adoption, particularly in DeFi and tokenized asset markets.

- Institutional demand remains robust due to Ethereum’s smart contract dominance.

- The decline appears more technical in nature than fundamental weakness.

- Support Levels: $4,400 and $4,200

- Resistance Levels: $4,700 and $5,000

If ETH holds above $4,400, bulls may attempt a rebound. Long-term investors still see Ethereum as the backbone of decentralized finance and Web3 infrastructure.

3. XRP – Price at $2.93 (-2.53%)

XRP, with a $179.26 billion market cap, closed at $2.93, slipping 2.53% in today’s session. Despite ongoing optimism surrounding Ripple’s global payment solutions and regulatory clarity in several regions, the token faces selling pressure near the $3.00 psychological level.

- Support: $2.70

- Resistance: $3.10

- Outlook: XRP remains a strong contender in the cross-border payments ecosystem, and its fundamentals are intact. Short-term corrections may provide entry opportunities for long-term believers.

4. Tether (USDT) – Stable at $0.9999 (+0.02%)

As the largest stablecoin with a $167.09 billion market cap, USDT remained anchored at $0.9999, posting a slight uptick of 0.02%. Stability in Tether underscores investor reliance on dollar-backed assets during volatile sessions.

Stablecoins continue to play a critical role in providing liquidity and enabling swift transactions in the crypto ecosystem.

5. Binance Coin (BNB) – Price at $853.83 (-1.07%)

BNB, the native token of Binance with a $120.36 billion market cap, closed at $853.83, down 1.07%. The decline is relatively milder compared to peers, showing resilience amid market-wide sell-offs.

- Support: $820

- Resistance: $900

- Outlook: With Binance expanding its ecosystem in both spot and derivatives trading, BNB remains a key player in utility-driven crypto demand. Long-term investors continue to hold BNB as an exchange backbone asset.

6. Solana (SOL) – Price at $195.87 (-4.12%)

Solana, one of the most prominent blockchain networks for speed and scalability, witnessed a sharp 4.12% decline, closing at $195.87. Its $111.07 billion market cap highlights its importance among altcoins.

- Support: $185

- Resistance: $205

- Key Insight: SOL’s decline today reflects short-term profit booking, but network usage in NFTs, gaming, and DeFi continues to expand. If the token sustains above $190, it could regain bullish momentum.

7. USD Coin (USDC) – Price at $0.9999 (+0.02%)

Another leading stablecoin, USDC, maintained parity at $0.9999, up 0.02%. With a $67.52 billion market cap, it remains a reliable digital dollar, widely used for payments, remittances, and DeFi applications.

Stablecoins like USDC and USDT remain the safe harbor for traders when volatility rises, highlighting their critical role in portfolio balancing.

8. Dogecoin (DOGE) – Price at $0.2185 (-4.82%)

Dogecoin, the meme-inspired cryptocurrency with a $34.70 billion market cap, faced the steepest decline among the top 8 tokens, dropping 4.82% to $0.2185.

- Support: $0.20

- Resistance: $0.24

- Investor Outlook: While Dogecoin’s fundamentals remain community-driven, speculative trading and broader market sell-offs weighed heavily today. Long-term adoption remains uncertain, but DOGE continues to attract retail enthusiasm.

Broader Market Sentiment – Neutral to Bearish

Today’s session reflects a cautious tone across the crypto market:

- Altcoin Index at 49 → Market is undecided, with neither bulls nor bears fully in control.

- Fear & Greed Index at 53 → Suggests mild optimism but not strong enough to drive aggressive buying.

- Stablecoin Strength → The inflow into stablecoins like USDT and USDC shows defensive positioning by traders.

Global macroeconomic conditions, including interest rate policies, U.S. inflation numbers, and regulatory updates, continue to play a pivotal role in shaping sentiment.

Key Takeaways for Investors

- Bitcoin at $111K – Still above critical psychological levels, but facing resistance.

- Ethereum under $4,600 – Pullback provides buying opportunities if it sustains above $4,400.

- Altcoins under pressure – Solana and Dogecoin saw sharper corrections, while XRP is holding near $3.

- Stablecoins show confidence – USDT and USDC stability suggests healthy market liquidity.

- Caution remains – Indicators suggest the market is not panicking but is consolidating after strong rallies earlier this month.

Final Outlook – 25th August 2025

The crypto market today showcased classic volatility, with Bitcoin and Ethereum leading the downside while altcoins mirrored the trend. Stablecoins provided safety, reinforcing their importance as balancing tools in portfolios.

Investors should watch Bitcoin’s $108,500 support and Ethereum’s $4,400 level in the short term. A rebound from these zones could spark renewed bullish momentum, but a breakdown could extend the correction further.

For long-term investors, the ongoing developments in Ethereum’s ecosystem, Solana’s network adoption, and Ripple’s global payment framework remain key themes to watch.

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

Subscribe Now , Join Telegram the Crypto Capital Club, Get Free Crypto Updates

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply