From Independence to Global Competitiveness – Sensex & Nifty’s Journey (1947–2025)

By CapitalKeeper | Independence Special | Indian Equities | Market Moves That Matter

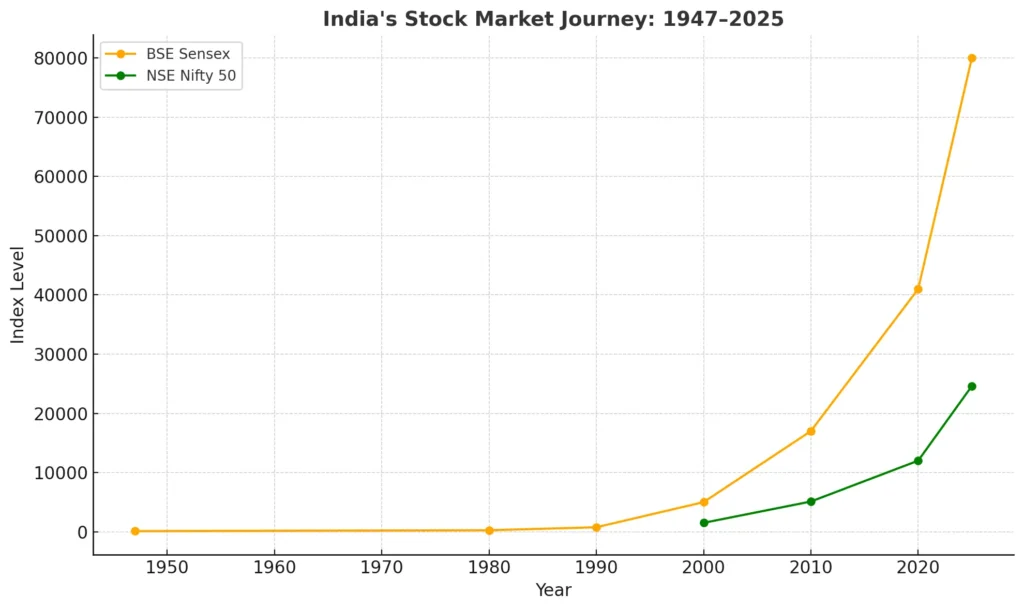

Historical Market Reflection: From 1947 to 2025 – India’s Stock Market Journey

Introduction

On 15th August 1947, as India hoisted its first tricolour as an independent nation, our economy was still recovering from the ravages of colonial rule. The Bombay Stock Exchange (BSE) existed, but the Sensex — today’s most recognised market barometer — was still decades away.

Fast forward to 2025, and India stands as the fifth-largest economy in the world, with the Sensex crossing the 80,000 mark and the Nifty 50 touching all-time highs above 24,000.

This journey wasn’t just about numbers climbing on a chart. It reflects policy reforms, industrial growth, technological adoption, global recognition, and the resilience of Indian investors. Let’s look at how the Sensex and Nifty evolved over nearly eight decades.

The Early Days: Pre-Sensex Era (1947–1979)

When India gained independence:

- The BSE was already over a century old (founded in 1875).

- Trading was manual, with brokers crowding in the ring, shouting bids and offers.

- There was no official Sensex index yet; stock movements were tracked through informal averages.

In the early decades post-independence:

- Industrialisation under the Five-Year Plans drove interest in stocks like Tata Steel, Hindustan Motors, and Indian Oil.

- The market was illiquid and highly speculative, with limited participation from the middle class.

Key Milestone:

- 1964 – The Unit Trust of India (UTI) launched, becoming the first state-sponsored mutual fund and paving the way for retail participation.

Birth of the Sensex (1980)

The BSE launched the Sensex in 1986, but it was calculated with a base year of 1978–79 (base value = 100). This index of 30 companies became India’s first official benchmark for market performance.

In its early years:

- Sensex hovered in the 100–250 range during the early 1980s.

- Limited foreign investment and a protected economy meant growth was slow but steady.

The Liberalisation Boom (1991–2000)

The turning point came in 1991, when India faced a balance-of-payments crisis and launched economic liberalisation under Dr. Manmohan Singh.

Impact on markets:

- Foreign Institutional Investors (FIIs) were allowed entry.

- Industrial sectors opened up, leading to rapid corporate expansion.

- The Sensex jumped from 1,000 in 1991 to 5,000 by 1999.

Key Events:

- 1994 – NSE launched with electronic trading, introducing the Nifty 50 index in 1996 (base year 1995, value 1,000).

- Nifty quickly became the preferred benchmark for derivatives and institutional investors.

Dot-Com Euphoria and Crash (2000–2003)

The late 1990s tech boom saw stocks soar, particularly IT companies like Infosys, Wipro, and Satyam.

- Sensex crossed 6,000 in 2000 for the first time.

- Nifty breached the 1,800 level.

However, the dot-com bubble burst globally in 2000–01, and the Ketan Parekh scam in India shook investor confidence.

- Sensex fell below 3,000 in 2001.

- Nifty dropped to near 900 levels.

The Golden Bull Run (2003–2008)

Economic reforms, infrastructure growth, and strong GDP numbers led to one of India’s most powerful bull runs.

- Sensex rose from 3,000 in 2003 to 21,000 in January 2008.

- Nifty moved from 1,000 to 6,300 in the same period.

Drivers:

- Massive FII inflows.

- IT and outsourcing boom.

- Real estate and banking sector growth.

Global Financial Crisis (2008)

The Lehman Brothers collapse and global recession hit India too.

- Sensex crashed from 21,000 to below 9,000 in 2008.

- Nifty fell from 6,300 to 2,700.

Government and RBI interventions, along with strong domestic demand, helped recovery by mid-2009.

Post-Crisis Growth and Reform (2009–2019)

The following decade was marked by:

- GST implementation (2017).

- Demonetisation (2016) — a short-term shock but long-term digitalisation push.

- Growth in sectors like FMCG, IT, pharma, and banking.

By 2019:

- Sensex hovered around 40,000.

- Nifty traded in the 12,000 range.

COVID-19 Shock and Historic Recovery (2020–2022)

In March 2020, COVID-19 triggered a market meltdown:

- Sensex dropped from 42,000 to 26,000 in a matter of weeks.

- Nifty crashed from 12,400 to 7,500.

But unprecedented liquidity measures, rapid vaccination, and global recovery led to:

- Sensex crossing 60,000 by late 2021.

- Nifty hitting 18,000.

The New Era: 2023–2025

India’s GDP growth, Make in India, Atmanirbhar Bharat, and infrastructure expansion have pushed markets to record highs.

- August 2025: Sensex at 80,000+, Nifty at 24,600+.

- Strong participation from domestic institutional investors (DIIs) and retail investors.

Chart: India’s Stock Market Journey (1947–2025)

Note: Values are rounded and for illustrative purposes.

Lessons from 78 Years of Market History

- Long-term patience wins: Investors who stayed invested through crashes saw exponential wealth creation.

- Policy reforms drive markets: Liberalisation in 1991, GST in 2017, and digitalisation reforms have acted as market boosters.

- Diversification matters: Sectoral cycles shift; no single sector leads forever.

- Domestic investors are now a major force: Reducing dependence on FII flows strengthens market stability.

Conclusion

From the days of manual trading to AI-driven algorithmic platforms, India’s stock market journey mirrors its economic evolution. The Sensex and Nifty are more than just numbers — they are reflections of India’s resilience, innovation, and ambition.

As we celebrate Independence Day, it’s worth remembering that financial independence and national independence go hand-in-hand. For the informed investor, history is not just a record — it’s a guide to building the future.

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

Subscribe Now , Join Telegram the Crypto Capital Club, Get Free Crypto Updates

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply