ELSS Mutual Funds vs PPF: Which Tax-Saving Option is Better in 2025? | CapitalKeeper

By CapitalKeeper | Beginner’s Guide | Mutual Funds | Market Moves That Matter

Compare ELSS mutual funds and PPF for tax savings in 2025. Understand returns, lock-in periods, and which investment is better for your financial goals.

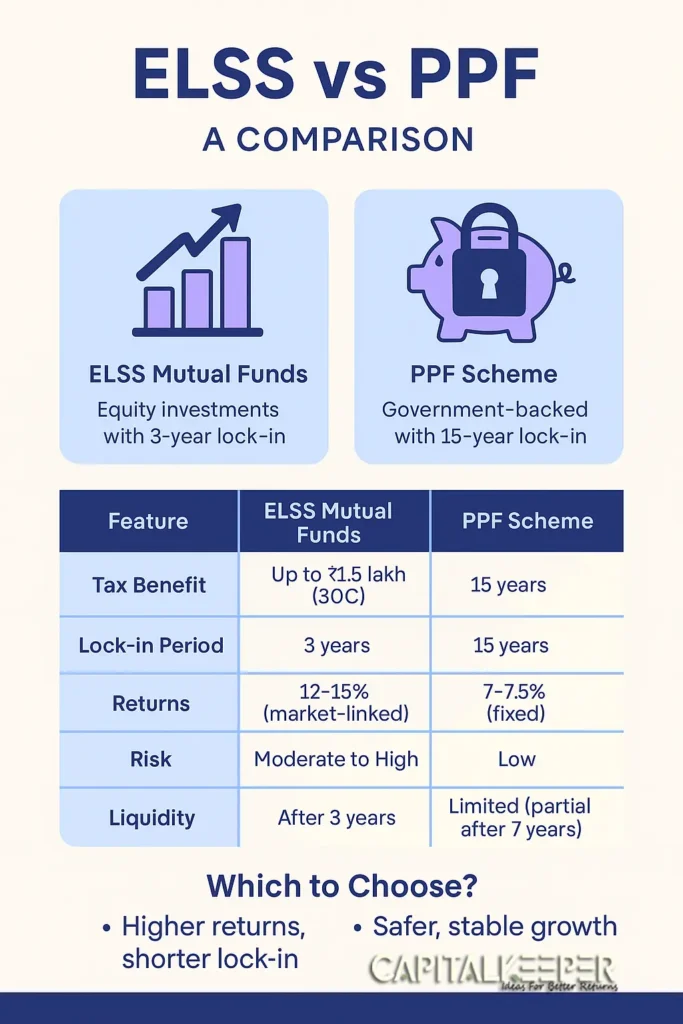

ELSS Mutual Funds vs PPF: Which Tax-Saving Option Should You Choose in 2025?

Indian investors often face the dilemma of choosing between Equity Linked Savings Schemes (ELSS) and the Public Provident Fund (PPF) for tax-saving under Section 80C. Both options help you reduce taxable income but differ significantly in returns, risk, and lock-in periods. Here’s a detailed comparison to help you decide in 2025.

1. Overview of ELSS Mutual Funds

- What are ELSS? Equity-based mutual funds that qualify for 80C tax deduction up to ₹1.5 lakh annually.

- Lock-in Period: 3 years (shortest among 80C options).

- Returns: Market-linked, typically 12–15% CAGR over long-term.

- Risk Profile: High (equity exposure).

- Best For: Investors with higher risk appetite and long-term goals (5+ years).

2. Overview of Public Provident Fund (PPF)

- What is PPF? A government-backed savings scheme offering guaranteed returns.

- Lock-in Period: 15 years (partial withdrawal after 7 years).

- Returns: Fixed, currently around 7.1% p.a. (reviewed quarterly).

- Risk Profile: Very low (sovereign guarantee).

- Best For: Conservative investors seeking assured returns and safety.

3. ELSS vs PPF: Quick Comparison Table

| Feature | ELSS Mutual Funds | PPF Scheme |

|---|---|---|

| Tax Benefit | Up to ₹1.5 lakh (80C) | Up to ₹1.5 lakh (80C) |

| Lock-in | 3 years | 15 years |

| Returns | 12–15% (market-linked) | 7–7.5% (fixed) |

| Risk | Moderate to High | Low (Govt backed) |

| Liquidity | After 3 years | Limited (partial after 7 years) |

4. Which One Should You Choose?

- Choose ELSS if:

- You aim for higher long-term wealth creation

- Comfortable with market volatility

- Want shortest lock-in among tax-saving options

- Choose PPF if:

- You prefer guaranteed returns and safety

- Long-term savings horizon (15 years)

- Risk-averse and want predictable growth

5. Can You Invest in Both?

Yes! Many investors use PPF for safety and ELSS for higher growth — balancing their tax-saving portfolio.

Pro Tip: Use SIP in ELSS

Instead of lump-sum investing in ELSS at year-end, start a monthly SIP to average market risks and ease cash flow planning. Use our SIP Calculator to project maturity values.

Plan Your Tax-Saving Portfolio Today!

Get expert tips on ELSS and other tax-saving mutual funds directly in your inbox.

Subscribe to CapitalKeeper Newsletter and optimize your 80C investments.

Try Our Free Tools:

- SIP Calculator – Plan monthly ELSS contributions

- Lumpsum Calculator – Check one-time investments

Next Read:

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.

Leave a Reply