Nifty & Bank Nifty Intraday Signals – Key Levels & Trend Analysis for 08 July 2025

By CapitalKeeper | Nifty & Bank Nifty | Indian Equities | Market Moves That Matter

Get today’s expert intraday trading signals for Nifty and Bank Nifty (08 July 2025). Discover support & resistance zones, FII data, PCR trends, VIX impact, and top sectors like PSU Banks to watch. Perfect for day traders seeking precision

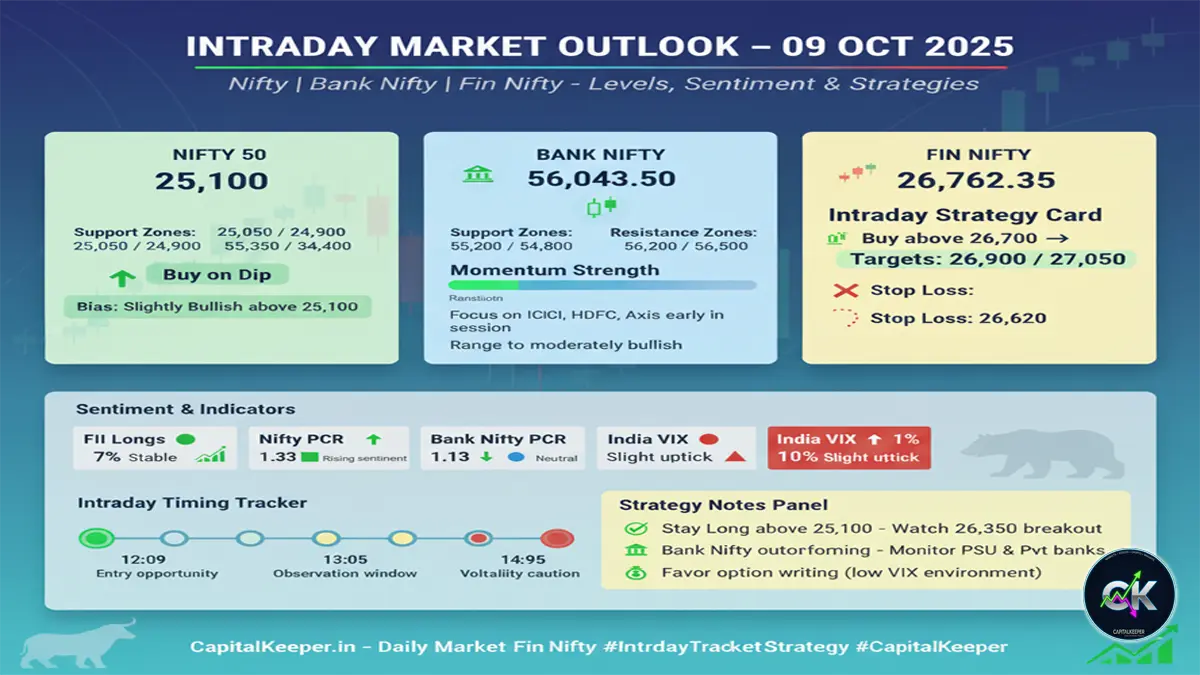

Market Sentiment Outlook:

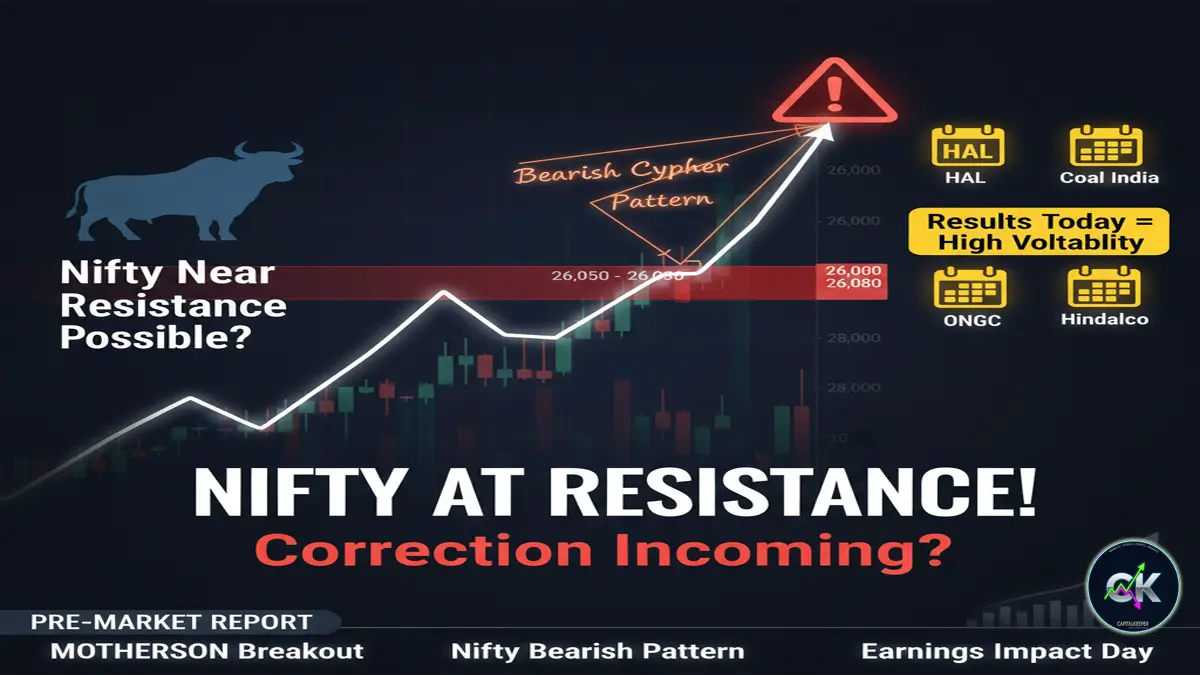

The market opens today with a neutral-to-cautious tone. Key indicators are stable, but VIX has ticked up by 2%, hinting at intraday volatility spikes. With FII long positions dipping slightly to 28.23%, traders are advised to prefer intraday scalps over positional longs.

❗️No Overnight Carry: Market sentiment suggests avoiding overnight long exposure due to global uncertainty and sector rotation.

⏰ Key Intraday Timings to Watch:

- 11:58 AM – Bullish bias likely to emerge

- 1:06 PM – Watch for Banking & PSU sector activity

- 1:59 PM – 🔥 Important trend decision zone

- 2:43 PM – Potential breakout/breakdown window

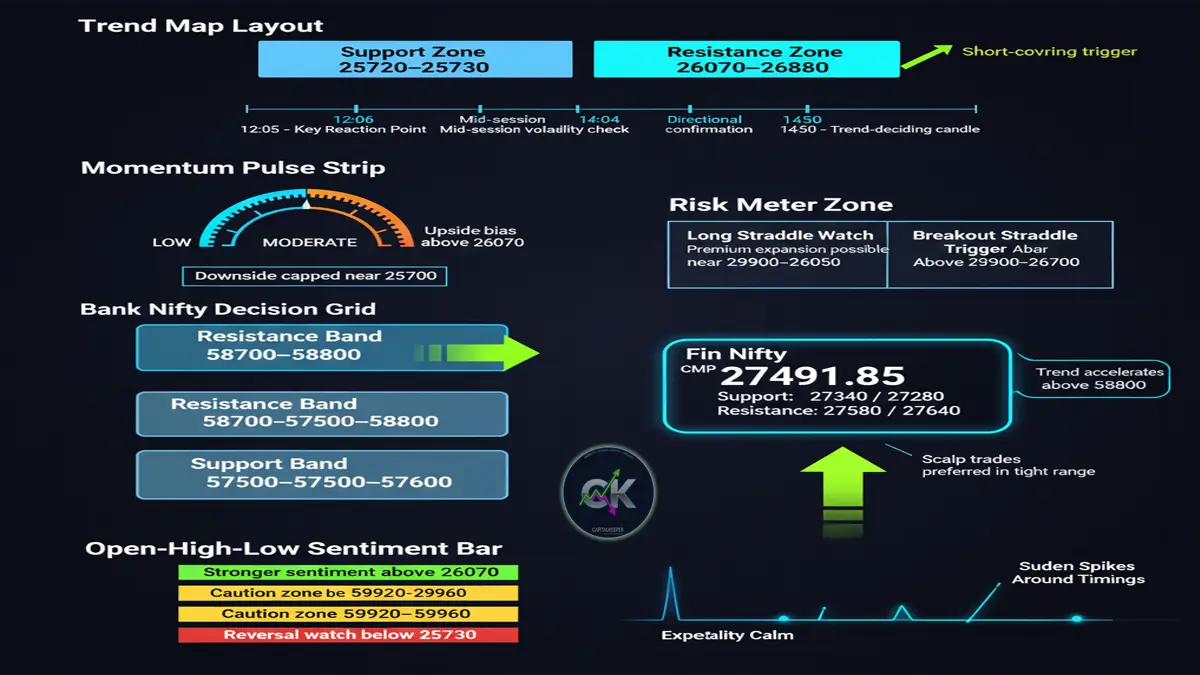

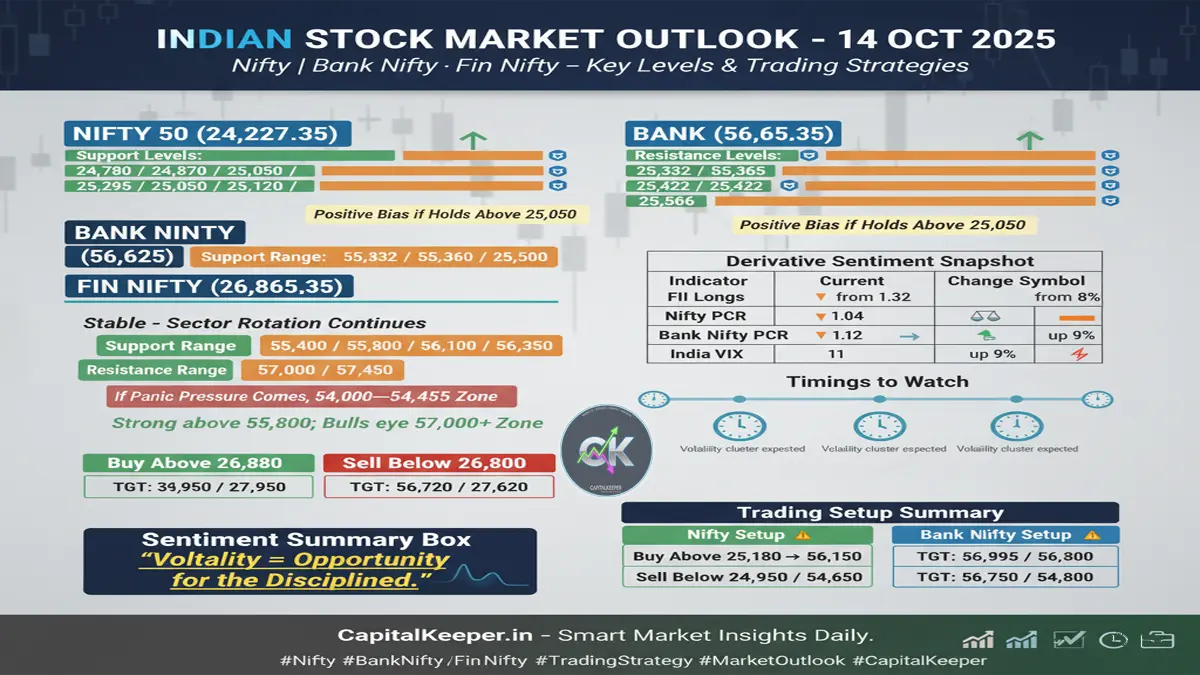

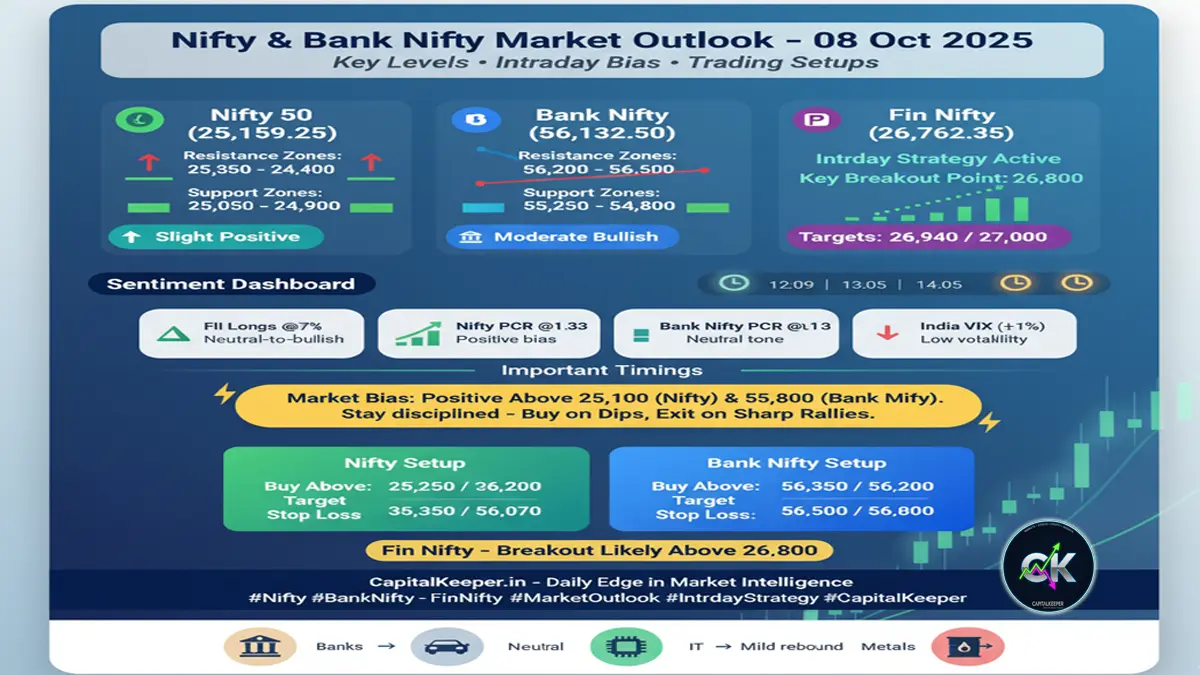

📊 NIFTY Spot Analysis (25,461.30)

🔻 Support Zones:

- 25,185 / 25,215

- 25,350

- 25,422 – Critical Intraday Level

🔺 Resistance Zones:

- 25,555.20

- 25,605 / 25,680

- 25,722 / 25,785 / 25,845

✅ Trade Plan:

Above 25,555, expect momentum buying toward 25,785–25,845

⚠️ Below 25,380, trend weakens – better to exit longs and scalp short

🏦 BANK NIFTY Spot Analysis (57,112.20)

🔻 Support Zones:

- 55,800 / 56,100 / 56,400

- 56,700 / 56,805

🔺 Resistance Zones:

- 57,210 / 57,300 / 57,450

- 57,600 / 57,840 / 58,065 / 58,200

✅ Trade Plan:

Above 57,210, Bank Nifty could trigger intraday longs toward 57,840–58,065

Below 56,805, expect consolidation or minor profit booking

🔍 Derivative Snapshot:

| Indicator | Current | Previous |

|---|---|---|

| FII Longs | 28.23% | 28.63% |

| Nifty PCR | 0.95 | 0.93 |

| Bank Nifty PCR | 1.00 | 1.01 |

| India VIX | 12.56 ⬆️ | 12.31 |

📌 PCR indicates neutral sentiment

📌 VIX up = sharp intraday moves likely

🔥 Intraday Sector Focus:

- ✅ PSU BANKS – Strongest setup today (Watch: SBI, BOB, Canara Bank)

- 🟡 AUTO & ENERGY – Mild momentum; only for quick scalps

- 🔁 IT & FMCG – Sideways to mildly corrective; stay stock-specific

📊 Fin Nifty (Current Spot: 26,920.25) – Key Technical Levels

🔻 Support Zones:

- 26,700 / 26,820

- 26,810 – Crucial intraday bounce zone

- 26,860 – Break below this may invite selling pressure

🔺 Resistance Zones:

- 27050 / 27,120 – Immediate resistance

- 27,185 / 27,236 – Breakout zone for strong rally

- 27,300+ – Positional breakout level

✅ Trade Plan Suggestion:

Above 27,050, intraday longs possible toward 27,185–27,236

Below 26,810, intraday trend weakens; best to scalp short with tight SL

📌 Volatility alert active. Use strict stop-loss on both long and short trades.

💡 Sector View – Financials Today:

- 🟢 PSU Banks – Outperformers; strong trend likely to continue

- 🟡 Private Banks – Stock-specific opportunities (HDFC Bank, ICICI)

- 🔁 NBFCs – Choppy, range-bound. Best avoided unless breakout confirmed

🎯 Intraday Trading Strategy:

- Focus on quick trades with strict SL around key levels

- Trail profits — don’t expect major swing continuation

- Avoid carrying trades overnight due to volatile global setup

- Watch PSU banks closely for the strongest intraday trades

🚨 Risk Disclaimer:

📌 This is purely a study-based view.

📈 Consult your SEBI-registered advisor before trading.

⛔️ Use strict stop-loss and position sizing.

🛑 Do not overtrade in volatile zones.

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.

By using this website, you agree to the terms of this disclaimer.

Leave a Reply