Types of Traders in the Stock Market: Which One Are You? 24 June 2025

By CapitalKeeper | Beginner’s Guide | Indian Sock Market | Market Moves That Matter I 24th June 2025

Types of Traders in the Stock Market: Which One Are You?

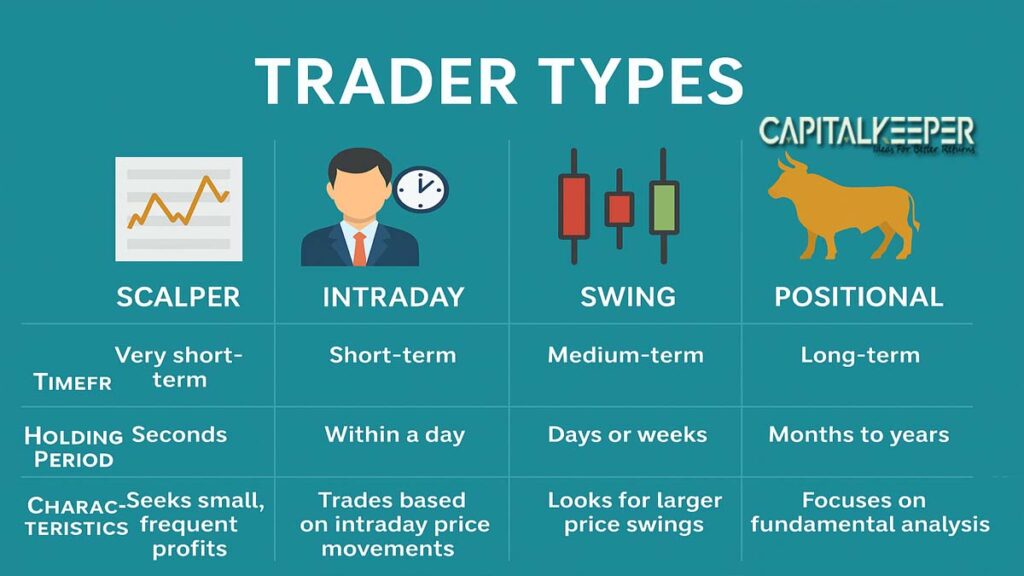

In the world of stock market investing, not all market participants operate the same way. Traders vary by their timeframes, strategy, risk appetite, and tools they use.

Whether you’re just starting out or looking to refine your edge, understanding the different types of traders can help you choose a path aligned with your goals, personality, and capital base.

📊 1. Scalpers – Masters of Micro Moves

⏱️ Timeframe: Seconds to Minutes

⚙️ Key Focus: Rapid-fire trades based on tiny price changes

🧮 Tools: Tick charts, order book depth, ultra-fast execution

Ideal For: Traders with high-speed connections, advanced platforms, and nerves of steel

📌 Example: Buy Bank Nifty futures at 55,200.50 and sell at 55,208.25 within 90 seconds.

⚠️ Risks:

- High brokerage/slippage

- Emotionally draining

- Needs razor-sharp discipline

📈 2. Intraday Traders – Same-Day In & Out

⏱️ Timeframe: Minutes to Hours

⚙️ Key Focus: Price action, volume, volatility

🧮 Tools: 5-min/15-min charts, VWAP, RSI, MACD

Ideal For: Traders who want no overnight risk and can monitor markets live

🧠 Example: Buy HDFC Bank at ₹1,640 at 10 AM, sell at ₹1,665 before 3 PM

✅ Benefits:

- No overnight gap-down risk

- Daily profit/loss control

- Liquidity focused on popular stocks or indices

📆 3. Swing Traders – Ride the Trend

⏱️ Timeframe: A few days to weeks

⚙️ Key Focus: Trend reversal patterns, support/resistance

🧮 Tools: Daily charts, EMA crossover, RSI divergence, candle formations

Ideal For: Part-time traders or professionals who want fewer trades with higher conviction

💡 Example: Buy ITC at ₹425 on bullish breakout and hold for ₹470 target over 7 days.

📅 4. Positional Traders – Mid-Term Market Movers

⏱️ Timeframe: Weeks to months

⚙️ Key Focus: Technical + Fundamental blend

🧮 Tools: Weekly charts, volume analysis, sector rotation, earnings momentum

Ideal For: Investors with a medium-term view who don’t want daily price stress

📌 Example: Accumulate L&T near ₹3,000 ahead of strong order book results and hold till ₹3,400.

🤖 5. Algorithmic Traders – The Code Warriors

⏱️ Timeframe: Depends on strategy — micro to multi-day

⚙️ Key Focus: Data science, statistical models, automated execution

🧮 Tools: Python, APIs, Quant platforms like Amibroker, Zerodha Kite Connect

Ideal For: Tech-savvy traders who want to remove emotion and scale volume

🤖 Strategy Example: Execute 50 long-short pairs based on arbitrage models in real-time.

💼 6. Fundamental Traders – Value Seekers

⏱️ Timeframe: Weeks to years

⚙️ Key Focus: Financials, business models, macro themes

🧮 Tools: Balance sheets, P/E ratios, management calls, sector outlooks

Ideal For: Investors with patience and long-term wealth-building focus

📈 Example: Invest in BEL based on Defence CapEx trends and hold for 2–3 years.

📉 7. News-Based Traders – Event Hunters

⏱️ Timeframe: Minutes to Days

⚙️ Key Focus: React to breaking news, earnings, macro data

🧮 Tools: News alerts, Twitter sentiment, Bloomberg feeds, RBI policy releases

Ideal For: Fast thinkers who can act on sentiment quickly before markets fully react

⚠️ Risk: Whipsaws, false news triggers, rapid volatility

🧭 How to Choose Your Trading Type?

| Factor | Scalping | Intraday | Swing | Positional | Algo | Fundamental |

|---|---|---|---|---|---|---|

| Time Availability | Full-time | Full-time | Part-time | Low | Medium | Low |

| Risk Appetite | High | High | Moderate | Moderate | Moderate | Low |

| Capital Required | High | Medium | Low-Medium | Low | High | Low |

| Emotion Involvement | High | High | Medium | Low | Low | Low |

📌 Conclusion: Know Thyself, Then Choose Your Style

Every trader must answer:

🔹 How much time can I give?

🔹 What’s my risk tolerance?

🔹 Do I enjoy fast decisions or slow thinking?

🔹 Do I want cash flow or long-term wealth?

Understanding these different trading types will help you build the right strategy, tools, and mindset for consistent success.

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.

By using this website, you agree to the terms of this disclaimer.

Leave a Reply