OPENING BELL – 16 June 2025 🔔 Muted Opening After Friday’s Breakdown — Markets Eye Global Cues Ahead

By CapitalKeeper | Market Opening | Intraday Ideas | Market Moves That Matter

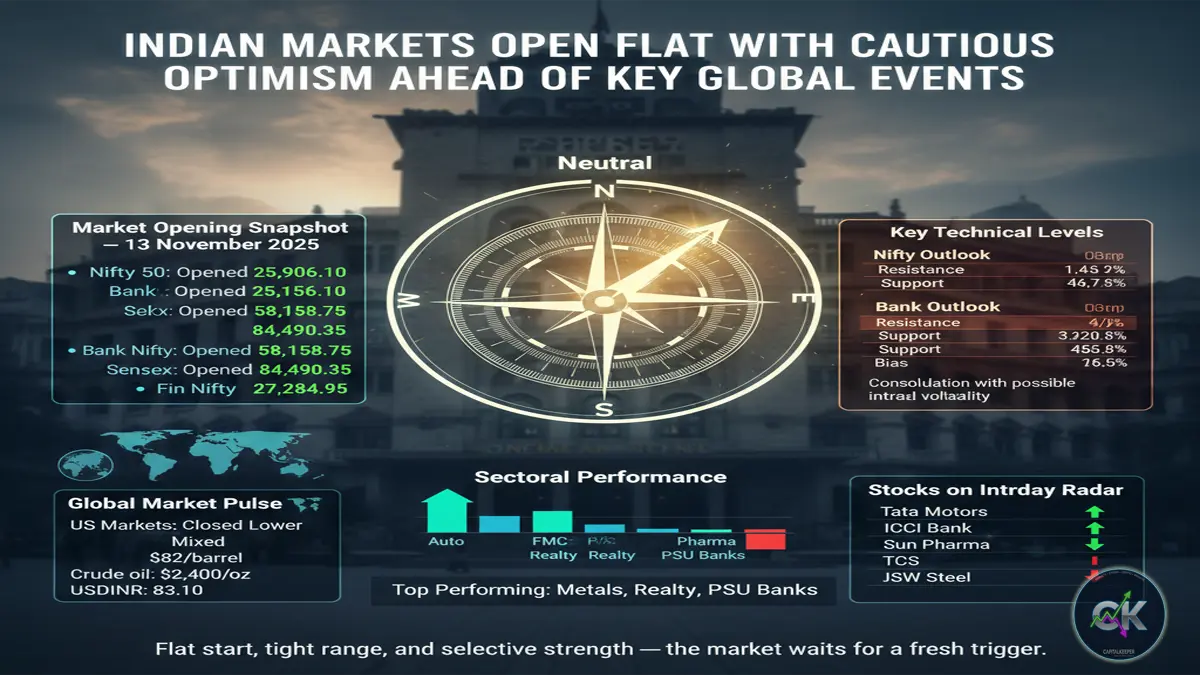

| Index | Previous Close | Today’s Open |

|---|---|---|

| Nifty 50 | 24,718.60 | 24,732.35 |

| Bank Nifty | 55,527.35 | 55,554.10 |

| Sensex | 81,118.60 | 81,034.45 |

| Fin Nifty | 26,335.60 | 26,385.60 |

📌 Market Opening Snapshot:

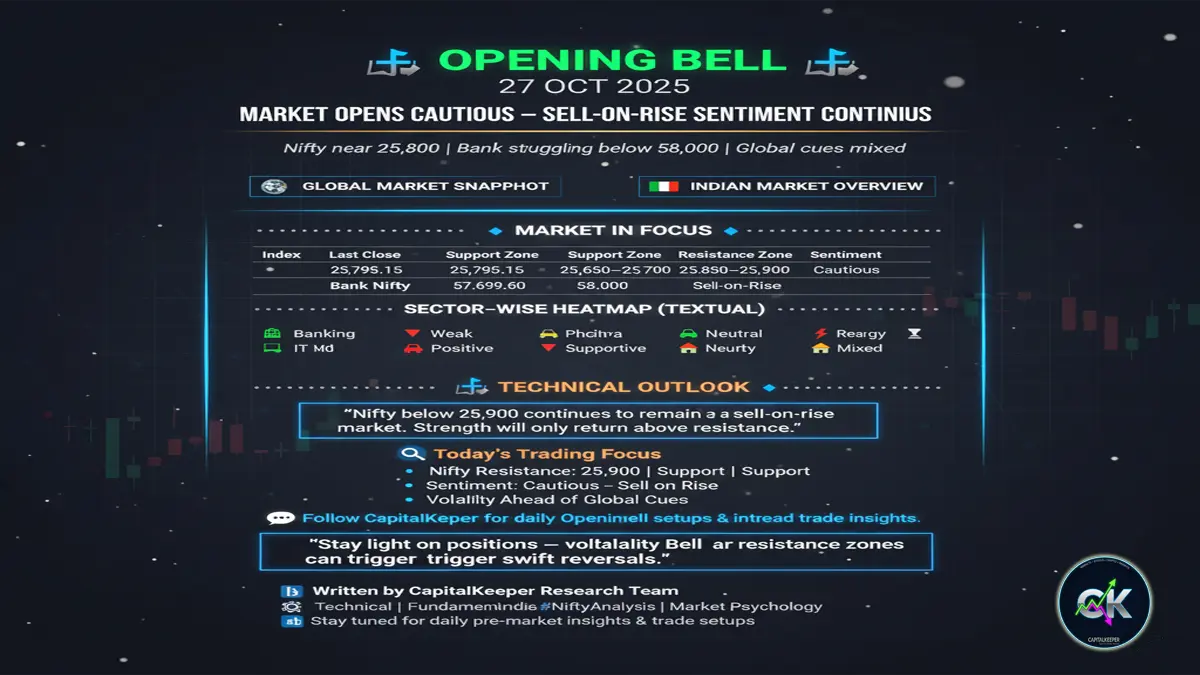

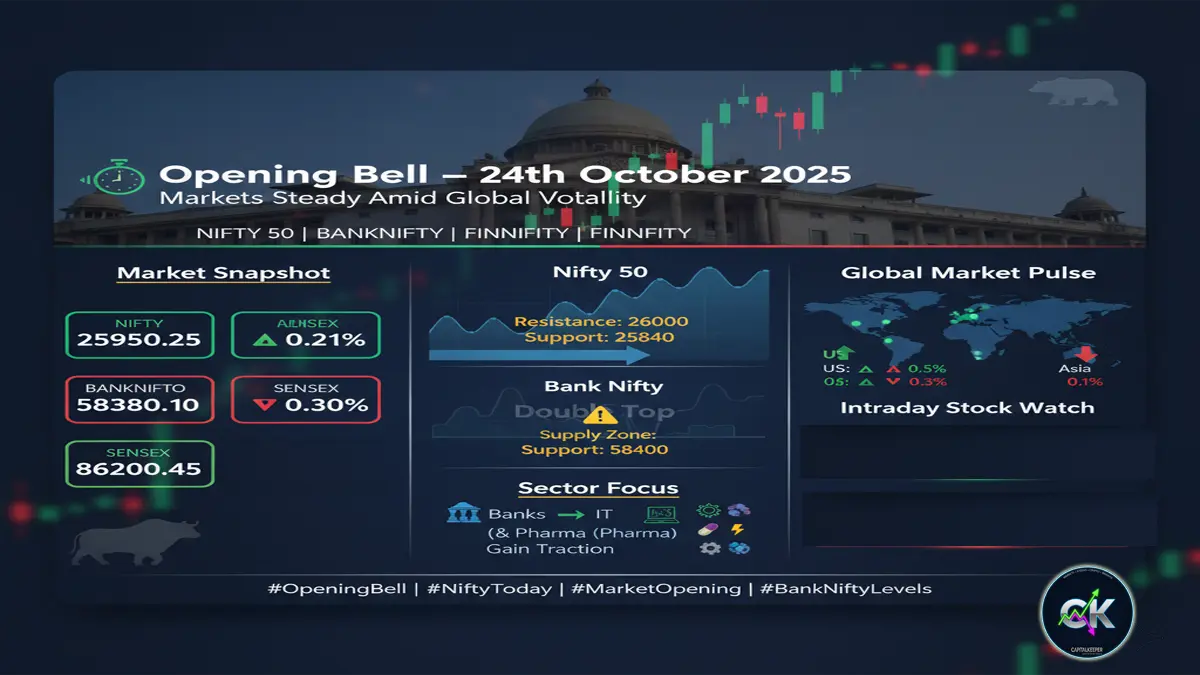

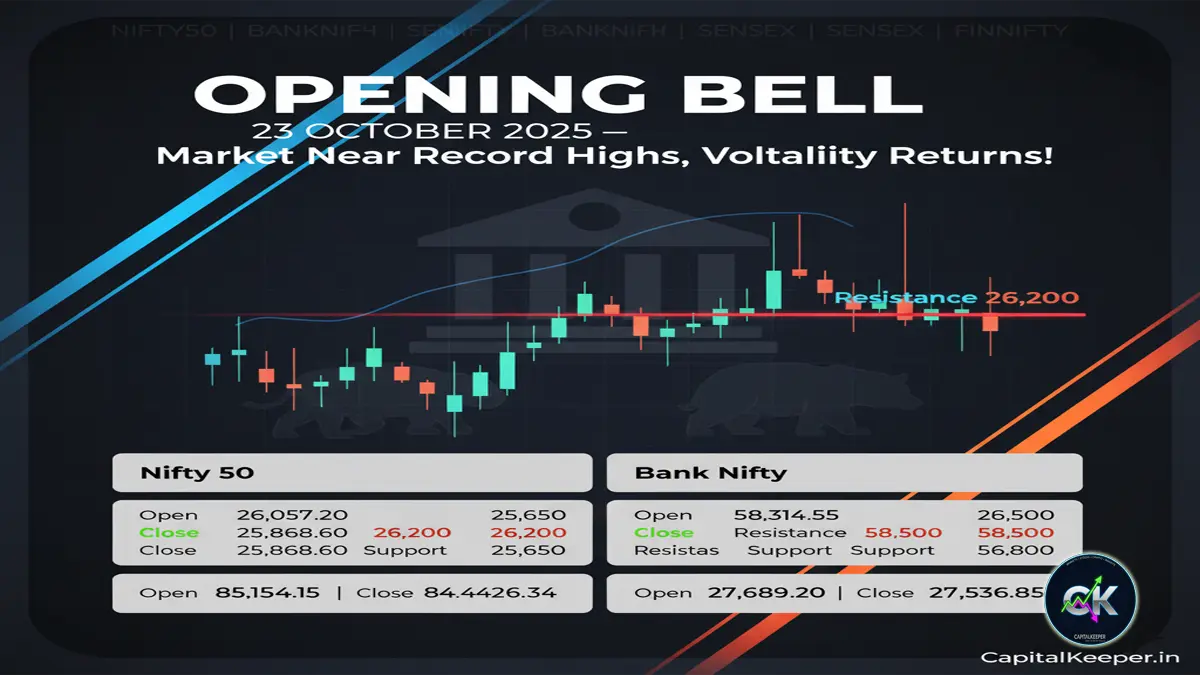

Indian stock markets opened flat to mildly positive on Monday as traders weighed the global cues post a volatile last week. While Nifty and Bank Nifty saw a technical breakdown on Friday, today’s opening shows a cautious bounce attempt. However, the key resistances must be reclaimed quickly, else weakness could extend.

Technical Levels to Watch:

- Nifty 50: Resistance at 24,850–25,000 zone. Support at 24,600 and then 24,420.

- Bank Nifty: Resistance at 56,000. Support at 55,200–54,900.

- Fin Nifty: Range bound between 26,200 and 26,600. Watch for breakout above 26,650.

📉 If indices fail to sustain above immediate resistance levels, a deeper retracement is likely.

Global Cues:

- U.S. Markets ended slightly lower on Friday as investors await fresh economic data and Fed commentary.

- Asian markets opened mixed today; Nikkei flat, Hang Seng mildly lower.

- Crude oil remains under pressure near $77; Brent around $81.

- INR stable near 83.48/USD, keeping importers cautious.

Sectoral View:

- Pharma & IT stocks showing early resilience.

- Metal and Auto sectors under slight pressure.

- FMCG sideways with stock-specific moves.

- Banking flat; PSU Banks trying to stabilize.

🚀 Top 5 Active Intraday Stocks – 16 June 2025:

- Cipla Ltd. (CMP ₹1,532.00)

🔹 Strong pharma momentum; fresh breakout watch above ₹1,500

🎯 Target: ₹1,600 | 🛑 SL: ₹1,500 - Axis Bank (CMP ₹1,198.50)

🔹 Holding support at 1,150; potential bounce if index recovers

🎯 Target: ₹1,220 | 🛑 SL: ₹1,160 - Tata Motors (CMP ₹674)

🔹 Auto weak, but Tata Motors showing strength on volume pickup

🎯 Target: ₹720 | 🛑 SL: ₹665 - LTIMindtree (CMP ₹5,398.00)

🔹 IT sector buzz continues; strong buying near ₹5,350 support

🎯 Target: ₹5,470 | 🛑 SL: ₹5,340 - Hindalco (CMP ₹638.30)

🔹 Metal under pressure; breakdown below ₹650 may trigger downside

⚠️ Sell on rise 🎯 Target: ₹618 | 🛑 SL: ₹665

Today’s Event Watchlist:

- No major domestic data, but traders eye U.S. Housing and Manufacturing data later today.

- Continued focus on monsoon updates and FII-DII flows.

📌 CapitalKeeper’s View:

“Both Nifty and Bank Nifty are trading below key resistances. Until 25,000+ and 56,000+ are decisively reclaimed, risk remains skewed to the downside. Stock-specific action and global cues will dictate intraday opportunities.”

📢 Stay tuned to CapitalKeeper for more intraday trading strategies, BTST stock picks, and global macro alerts.

✅ For real-time intraday levels, market analysis, and sector-specific reports — stay connected with us at CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and subscribe to our newsletter!

🔍 By CapitalKeeper.in — Your Trusted Financial Insight Partner

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.

By using this website, you agree to the terms of this disclaimer.

Leave a Reply