The Global Rate Cut Wave: What It Means for You, India, and the World Economy 🌍

By CapitalKeeper | Empowering citizens, protecting portfolios, and explaining the economy – one rate cut at a time.

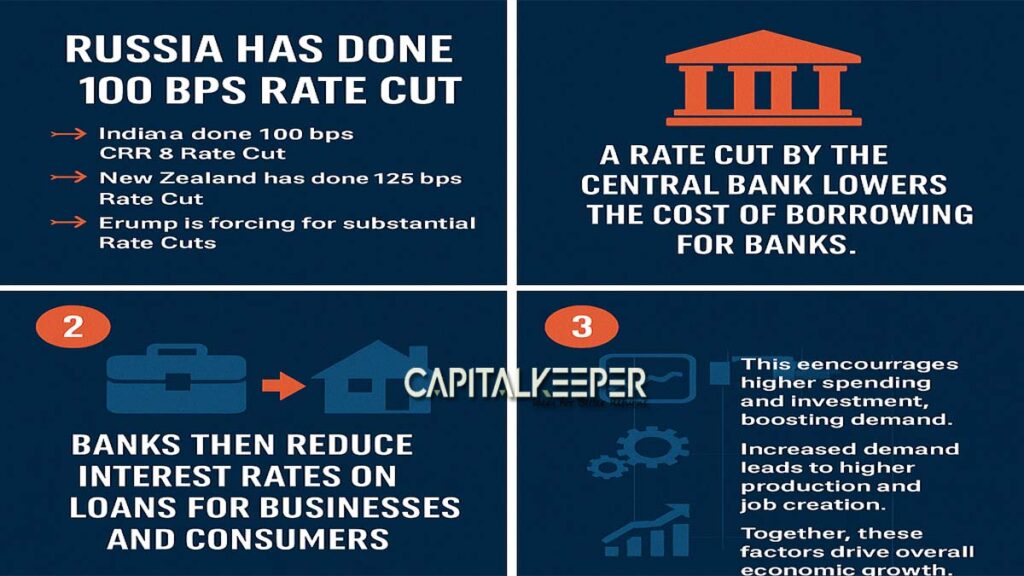

In a striking move that signals a shift in global monetary policy, multiple countries — including Russia, India, New Zealand, and several major economies in Europe — have initiated aggressive rate cuts to stimulate economic growth.

These aren’t minor tweaks. We’re witnessing:

- Russia: 100 basis points (bps) rate cut

- India: 100 bps combined rate cut & CRR (Cash Reserve Ratio) cut

- New Zealand: 125 bps rate cut

- Europe, UK, Canada, Mexico, Sweden: Major cuts announced

- Trump (US context): Openly demanding substantial rate cuts from the Fed

But why is this happening? What does it mean for you as a borrower, investor, or even a citizen trying to understand your economic surroundings?

Let’s unpack the logic and the ripple effects.

💸 What Is a Rate Cut?

A rate cut refers to a reduction in the interest rate at which a country’s central bank lends money to commercial banks. In India, this rate is known as the repo rate.

Similarly, the CRR (Cash Reserve Ratio) is the portion of deposits that commercial banks must keep with the Reserve Bank of India (RBI). Lowering the CRR allows banks to lend more.

📉 Why Are Central Banks Cutting Rates Globally?

The answer lies in sluggish growth, low inflation, and geopolitical headwinds. With uncertainties looming (like geopolitical conflicts, elections, and trade instability), central banks are preemptively boosting liquidity to:

- Stimulate spending and investments

- Prevent deflation

- Counter economic slowdown

- Support employment and credit markets

🔁 How Does a Rate Cut Impact the Economy?

Here’s a simple step-by-step breakdown:

1️⃣ Lower Cost of Borrowing

When the central bank slashes the repo rate, banks can borrow money more cheaply. This improves liquidity in the banking system.

2️⃣ Cheaper Loans for Everyone

In turn, commercial banks reduce interest rates on:

- Home loans

- Business loans

- Personal loans

- Car loans

This makes it easier for people and businesses to access funds.

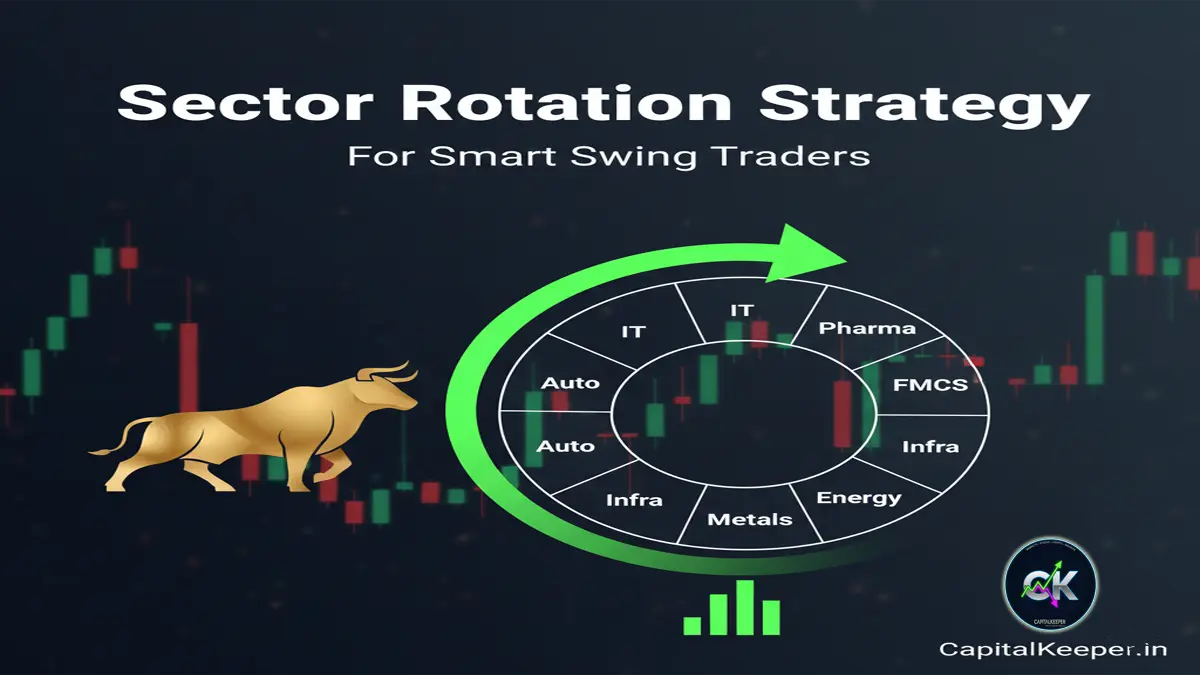

3️⃣ Increased Spending and Investment

With cheaper loans:

- Consumers buy more homes, vehicles, electronics, etc.

- Businesses invest in new machinery, capacity, and innovation

This boosts demand across sectors.

4️⃣ Production and Employment Rise

Higher demand leads to:

- More manufacturing and services output

- Greater hiring and job creation

5️⃣ Economic Growth Picks Up

The result? A stimulated economy with stronger GDP growth, healthier corporate earnings, and higher market participation.

🇮🇳 India’s 100 bps Cut: What It Means Locally

India’s 100 basis points repo rate and CRR cut is a bold move by the RBI to inject liquidity and push banks to lend more aggressively. This is particularly critical in the current environment of:

- Slow credit offtake

- High youth unemployment

- Urban consumption decline

- Rural distress and inflationary caution

If banks pass on this cut effectively, expect:

- Home loan EMIs to fall

- Real estate demand to pick up

- NBFCs to lend more

- Auto and consumer durables to see a revival

How Should You Respond as a Citizen and Investor?

| Situation | Impact | What You Should Do |

|---|---|---|

| Lower Interest Rates | EMIs become cheaper | Refinance loans, avoid unnecessary debt |

| Falling FD Returns | Returns shrink | Diversify into mutual funds, bonds, stocks |

| Rising Stock Markets | More liquidity fuels markets | Pick quality stocks & SIPs |

| High Inflation Risk | Long-term effect of loose money | Invest in inflation-beating assets |

| Weak Currency Risk | Due to low rates | Hedge international exposure |

🔮 Global Synchronization: What’s Next?

We’re currently in a synchronized global monetary easing cycle. While this is generally positive for economic momentum and asset prices, it also comes with medium-term risks like:

- Currency depreciation

- Asset bubbles

- Overheating inflation

- Reduced room for future stimulus

Central banks must walk a tightrope between reviving growth and maintaining macro stability.

Final Thoughts: Be a Financial Protector in a Low-Rate World

In such environments:

- Be vigilant with savings and investment strategies

- Don’t rely on fixed-income instruments alone

- Borrow wisely, only for productive purposes

- Make tax-smart, goal-aligned investments

- Focus on diversification across assets and geographies

This is the time to think like a financial protector — someone who can manage low rates without compromising on returns or risk.

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

Leave a Reply