Understanding RBI Policy & Rate Cuts: What It Means for You and Your Finances

By CapitalKeeper | Weekly Educational | Finance |

India’s economy, like any other, runs on a fine balance of interest rates, inflation, growth, and liquidity. At the center of this balance stands the Reserve Bank of India (RBI) – the nation’s central bank – which formulates and implements monetary policy. One of the most influential tools the RBI uses is changing interest rates, especially repo rates.

Recently, the RBI announced a rate cut, sparking discussions across financial markets and newsrooms. But what does this actually mean for a common citizen? And how should one adapt their financial behavior to avoid common glitches during such shifts?

Let’s break it down.

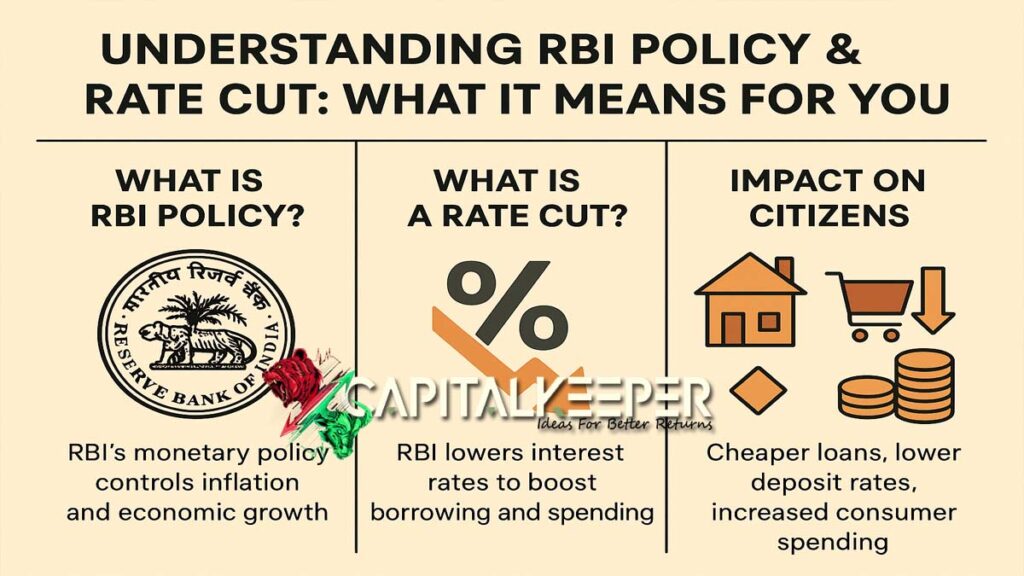

🔍 What is the RBI Monetary Policy?

The RBI Monetary Policy is a framework used by the central bank to control:

- Inflation (rise in prices)

- Liquidity (money supply in the economy)

- Interest rates

- Economic growth

Every two months, the Monetary Policy Committee (MPC), a six-member panel within RBI, meets to decide on the policy stance, primarily focusing on the repo rate.

📉 What is a Rate Cut?

A rate cut means the RBI lowers the repo rate – the interest rate at which commercial banks borrow money from the RBI. When the repo rate is reduced, borrowing becomes cheaper for banks, and in turn, they lower the rates for loans and deposits for the public.

💡 Quick Definitions:

| Term | Meaning |

|---|---|

| Repo Rate | Rate at which RBI lends to commercial banks |

| Reverse Repo | Rate at which RBI borrows from commercial banks |

| CRR (Cash Reserve Ratio) | Minimum cash banks must keep with RBI |

| SLR (Statutory Liquidity Ratio) | Minimum percentage of deposits banks must keep in liquid assets |

| Monetary Policy Stance | The RBI’s tone – accommodative (easy), neutral, or tightening |

🏦 Why Does the RBI Cut Rates?

RBI cuts rates to:

- Boost economic activity (especially during slowdowns)

- Encourage consumer spending

- Lower borrowing costs for businesses

- Support job creation and investment

- Control inflation (if it’s too low)

💬 Example:

During the COVID-19 pandemic, RBI slashed rates to support households and revive the economy.

📊 How Does a Rate Cut Impact Our Daily Lives?

1. 🏡 Home Loan EMIs Get Cheaper

- Floating-rate loans (home/car/personal loans) become less expensive

- Existing EMIs may reduce over time

- Encourages more people to take loans and invest in property

2. 💳 Increased Borrowing, Less Saving

- Consumers prefer spending over saving as interest on deposits decreases

- This can drive demand in the economy, aiding growth

3. 📉 Lower Returns on Fixed Deposits

- FD and RD interest rates drop

- Senior citizens and conservative investors face lower income

4. 📈 Stock Market Reaction

- A rate cut often boosts investor sentiment

- Banking, real estate, auto, and infrastructure sectors generally rally

- However, lower interest income may hurt banks’ net interest margins

5. 🛍️ Boost in Consumer Spending

- EMI burden eases, disposable income rises

- People are likely to spend more on travel, appliances, and luxury goods

🧠 How to Behave Smartly During Rate Cuts? (Financial Wisdom)

✅ 1. Reassess Your Loans

- Switch from fixed to floating interest rates if possible

- Consider refinancing your home loan for better terms

✅ 2. Diversify Your Investments

- Don’t rely only on FDs or RDs

- Explore mutual funds, government bonds, REITs, and equity markets

✅ 3. Emergency Fund is a Must

- Even during low interest periods, an emergency fund (6-12 months of expenses) is non-negotiable

✅ 4. Watch Inflation Trends

- Rate cuts may lead to inflation rise later – monitor your expenses

- Adjust your SIPs and savings to outpace inflation

✅ 5. Don’t Chase High Returns Blindly

- In a low-interest environment, risky investments may look attractive

- But don’t compromise your risk profile or liquidity needs

⚠️ Common Glitches People Face

| Mistake | Impact |

|---|---|

| Keeping all money in savings/FDs | Poor returns, loss vs inflation |

| Taking too much debt due to lower EMI | Overleveraging, financial stress |

| Ignoring floating-rate advantages | Missed opportunity for EMI reduction |

| Lack of budgeting during inflation | Lifestyle inflation, debt traps |

| Not investing in growth-oriented assets | Wealth erosion over time |

📌 Final Thoughts

RBI’s rate cut is not just a monetary decision—it affects the entire financial ecosystem, from the stock market to your pocket. While it aims to stimulate the economy, it requires us as citizens to be smarter in managing our loans, savings, and investments.

Adapt to the changing economic environment, not react emotionally. With financial discipline, the RBI’s policy decisions can be used to your advantage.

💬 What Should You Do Now?

- Rebalance your portfolio

- Review your debts and EMIs

- Start/increase SIPs to combat low deposit returns

- Use this period to invest in your financial knowledge

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

Leave a Reply