Tuesday Pulse & Derivatives Outlook -03rd June 2025

By CapitalKeeper | Nifty & Bank Nifty | Indian Equities | Market Moves That Matter

Tuesday Pulse & Derivatives Outlook -03rd June 2025

SENSEX Weekly Expiry | Elevated Volatility | Resistance Zone in Focus

Welcome to your daily Trend MiX — your compact market intelligence brief, tailored for traders, investors, and financial strategists. As we step into Sensex weekly expiry, the market tone remains cautiously optimistic, but technical barriers are tightening.

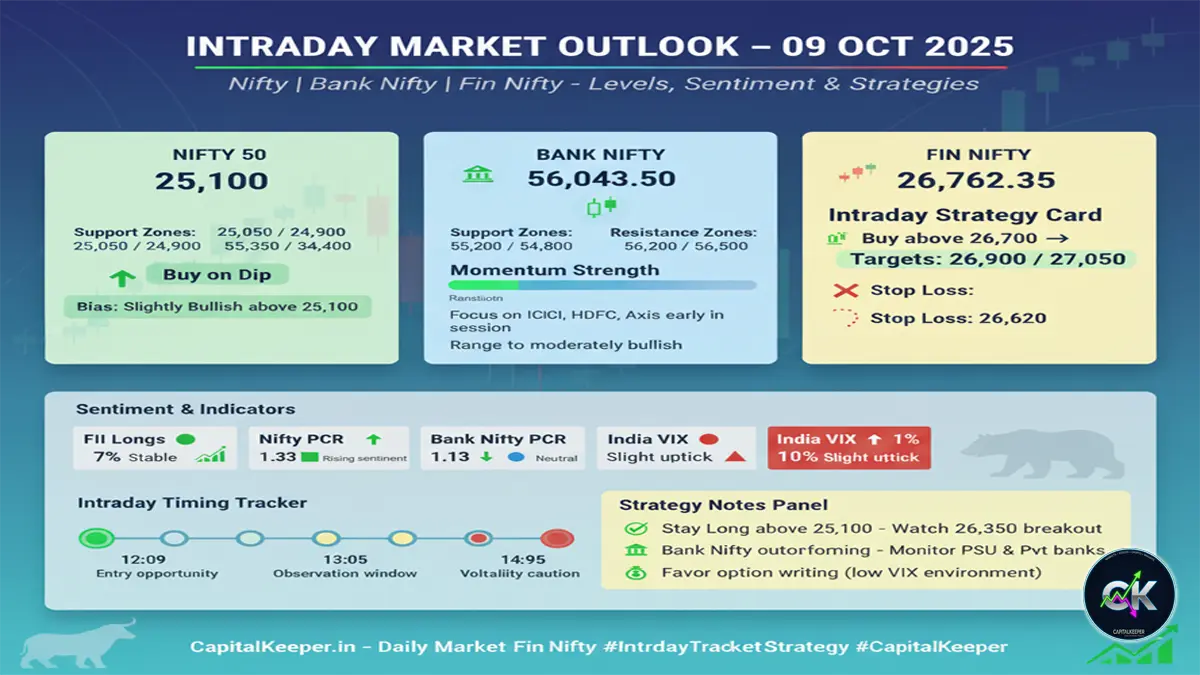

🔍 STUDY VIEW FOR TODAY

- FII Index Longs remain flat at 19%, indicating no additional bullish build-up from institutional players.

- Nifty PCR climbs to 0.82 from 0.77, hinting at slight bullish undertones.

- Bank Nifty PCR eases to 1.04 from 1.05 – still within healthy sentiment range.

- India VIX spikes to 17.16, up by 7%, bringing in a layer of uncertainty and caution.

🔔 Volatility has returned — though no crash signals, traders are advised to continue the buy-on-dips strategy above 24,400 spot.

📉 Below 24,400, the index could slide towards 24,000 or 23,850 levels.

🚨 Remain extra cautious below 24,684.

🔼 Sectors Looking Bullish

- PSU Banks & Private Banks

- Midcaps 100 (Stock specific)

- Smallcaps 100 (Stock specific)

- Railway Stocks

- Auto Sector

- Energy & Power

🔻 Cautious Stance Required In:

- PSEs (Public Sector Enterprises)

- Defense Stocks

- FMCG (Only stock-specific picks advisable)

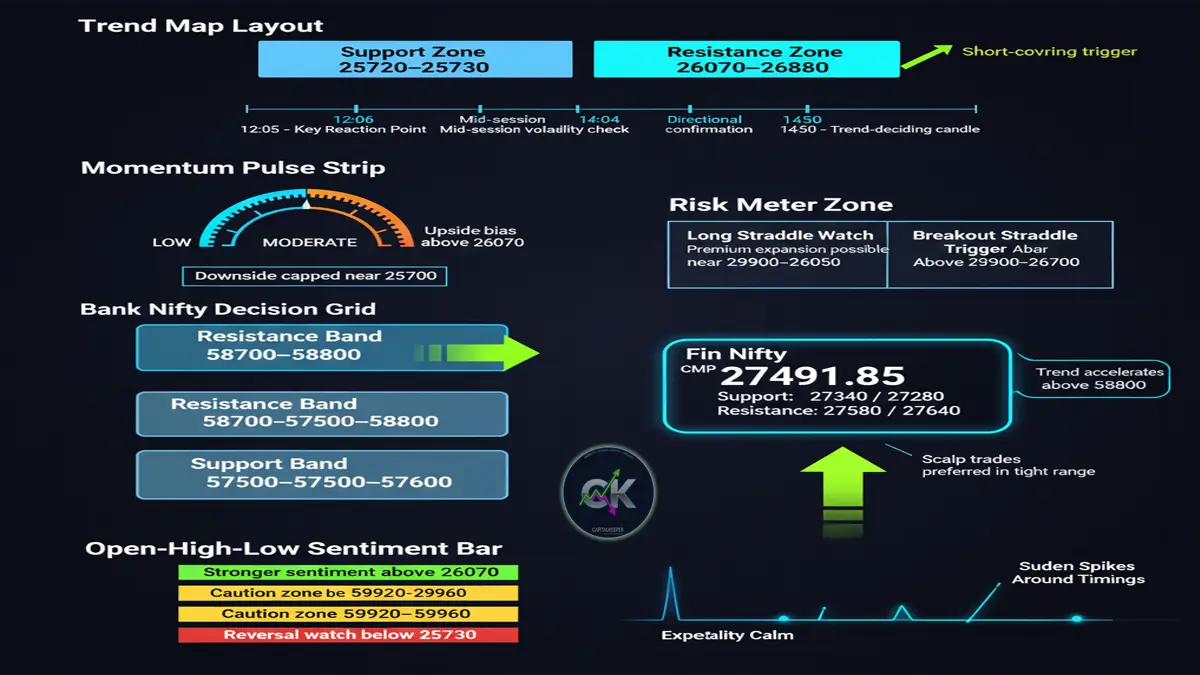

🔧 Technical Levels to Watch

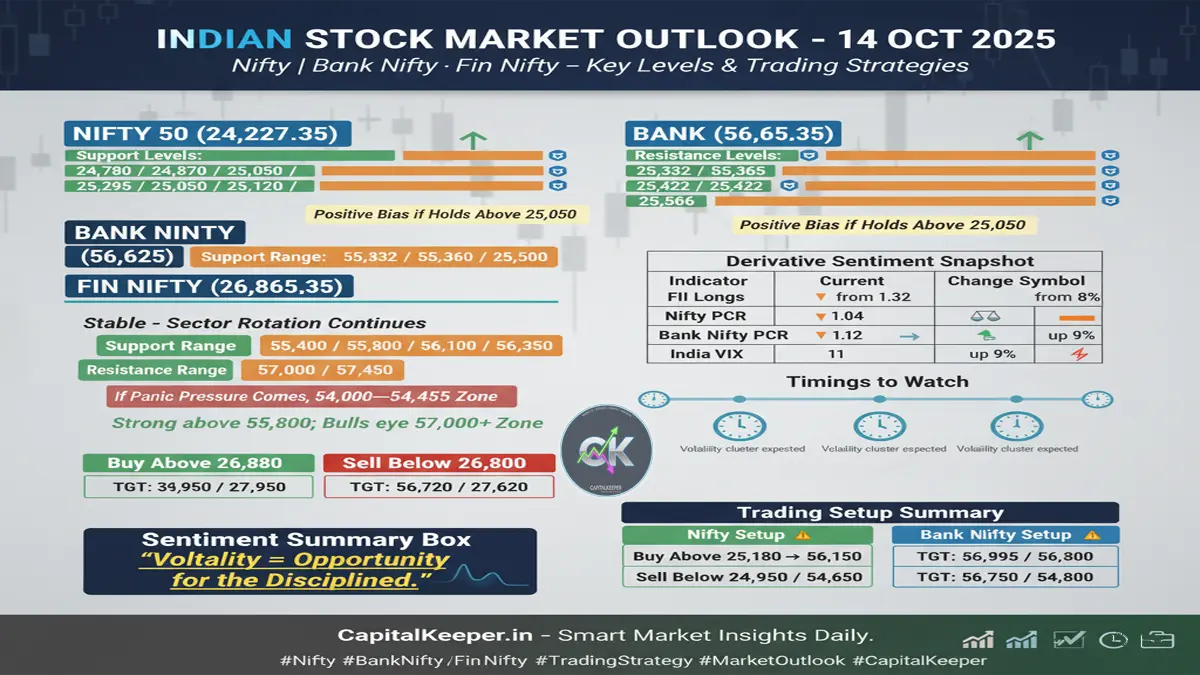

📊 NIFTY (Spot: 24,716.60)

- Resistance Levels:

- 24,780 / 24,855 / 24,930

- 25,030 / 25,070 / 25,152 / 25,210

- ⬆️ Above 25,210 → 25,300 / 25,395+

- Support Levels:

- 24,400 / 24,510 / 24,555

- 24,600 / 24,684

📌 Key Alert:

“There is a high likelihood that Big Daddy’s (institutions) will incur a write-off around 24,800 levels. This explains the repeated rejection we’ve seen near this zone over the last 4 sessions. The bulls’ major challenge is breaking out of this congestion zone to achieve the Wolfe Wave target near 25,113.”

📊 BANKNIFTY (Spot: 55,903.40)

- Resistance Levels:

- 55,950 / 56,100 / 56,300

- 56,400 / 56,700

- Support Levels:

- 54,000 / 54,255 / 54,450 / 54,510

- 54,600 / 54,855 / 55,005 / 55,200

- 55,350 / 55,500 / 55,710

⏰ Important Timings to Watch (Intraday Reactions)

- 🕛 12:24 PM

- 🕐 01:05 PM

- 🕑 02:22 PM

🧠 CapitalKeeper’s Takeaway

- Watch out for price action around 24,800 – it’s the key wall to climb.

- A clean breakout with volume above this congestion zone may fuel momentum towards 25,113+, completing the Wolfe Wave target.

- Maintain a disciplined stop-loss strategy around major intraday supports and don’t chase breakouts blindly in this volatility.

- Stock-specific trades in Auto, Railways, and Banks are likely to offer short-term momentum.

📢 Stay tuned to CapitalKeeper.in for more real-time updates and actionable insights throughout the trading day.

Conclusion:

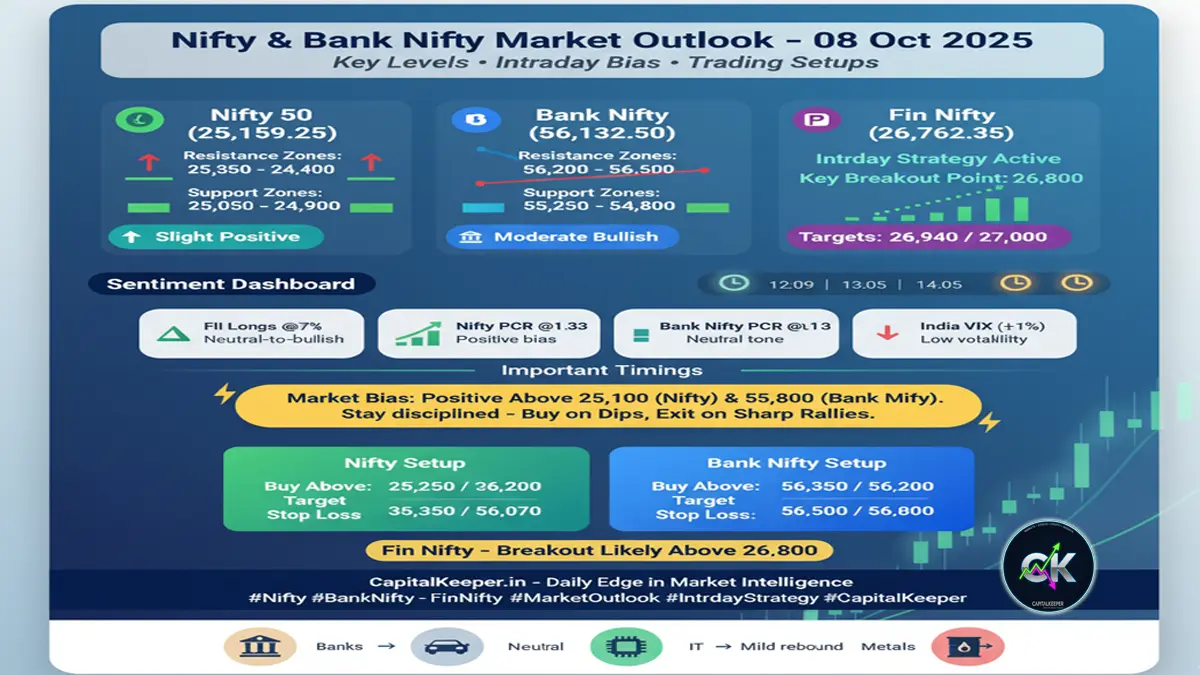

The Indian equity markets are currently navigating through mixed signals, with Nifty 50 showing signs of consolidation, Bank Nifty exhibiting neutral momentum, and Fin Nifty displaying cautious optimism. Traders and investors should monitor key support and resistance levels, along with global economic developments, to make informed decisions.

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.

By using this website, you agree to the terms of this disclaimer.

Leave a Reply