Commodity Morning Outlook 🌅 – 02 June 2025

Gold @ ₹96,387 | Silver @ ₹97,425 | Crude Oil @ ₹5,349 | Natural Gas @ ₹302.30

Global Cues, Dollar Index Impact & Technical Analysis

By CapitalKeeper – Your Morning Commodity Edge

🌍 Global Market Cues

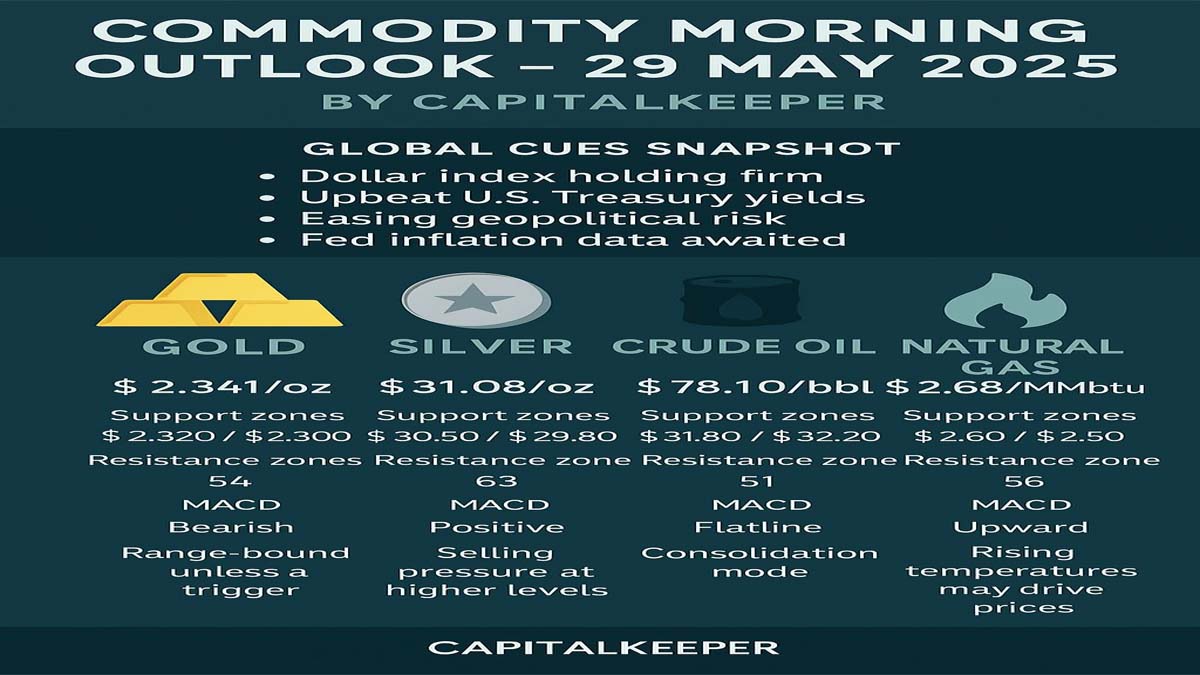

- Dollar Index (DXY): Currently hovering near 104.25, showing slight weakness as traders await upcoming U.S. job market data and inflation outlook.

- US Economic Data: All eyes on the upcoming JOLTS and Non-Farm Payrolls this week, which could reshape Fed’s interest rate trajectory.

- Geopolitical Factors: Elevated Middle East tension and cautious optimism on economic growth continue to influence commodity flow and investor sentiment.

🪙 Precious Metals

🟡 Gold – ₹96,387 (MCX August Futures)

- Global View: Spot gold hovering near $2,345/oz, supported by lower treasury yields and risk-off sentiment.

- Technical Support: ₹95,800 / ₹95,100

- Resistance: ₹97,000 / ₹98,200

- Indicators:

- RSI: 58 – Positive Bias

- MACD: Above Signal Line

- Strategy: Buy on dips around ₹95,800 with SL ₹95,100. Immediate target ₹97,000; breakout may lead to ₹98,200.

⚪ Silver – ₹97,425 (MCX July Futures)

- Global View: Silver tracking gold’s strength and industrial demand optimism from China.

- Support Levels: ₹96,000 / ₹94,500

- Resistance: ₹98,800 / ₹100,500

- Indicators:

- RSI: 62 – Bullish

- MACD: Turning positive

- Strategy: Buy near ₹96,000 with SL ₹94,500. Target ₹98,800–₹100,500 for short term.

🛢️ Energy Pack

🟠 Crude Oil – ₹5,349 (MCX June Futures)

- Global Price: Brent crude near $79.70/bbl. Market digesting weak Chinese data vs summer fuel demand and OPEC+ commitment.

- Support: ₹5,250 / ₹5,120

- Resistance: ₹5,520 / ₹5,650

- Indicators:

- RSI: 51 – Neutral

- MACD: Flat, potential bullish crossover

- Strategy: Buy on dips toward ₹5,250 with SL ₹5,120. Upside targets at ₹5,520–₹5,650 on breakout confirmation.

🔵 Natural Gas – ₹302.30 (MCX June Futures)

- Fundamentals: Higher power usage forecast in U.S. due to warmer weather could lift demand.

- Support Zones: ₹295 / ₹285

- Resistance: ₹312 / ₹328

- Indicators:

- RSI: 55 – Mild bullish tone

- MACD: In positive territory

- Strategy: Accumulate above ₹295. Target range ₹312–₹328. SL below ₹285.

📊 Summary – Technical Levels at a Glance

| Commodity | CMP | Support Zone | Resistance Zone | Strategy |

|---|---|---|---|---|

| Gold | ₹96,387 | ₹95,800 / ₹95,100 | ₹97,000 / ₹98,200 | Buy on dips |

| Silver | ₹97,425 | ₹96,000 / ₹94,500 | ₹98,800 / ₹100,500 | Positive bias |

| Crude Oil | ₹5,349 | ₹5,250 / ₹5,120 | ₹5,520 / ₹5,650 | Range breakout expected |

| Nat. Gas | ₹302.30 | ₹295 / ₹285 | ₹312 / ₹328 | Accumulate near support |

🧠 CapitalKeeper Takeaway

Precious metals continue to shine as global uncertainties weigh on risk appetite. Crude oil hovers around key technical levels with a possible upside breakout, while natural gas shows strength amid changing weather patterns. Maintain discipline with stop-loss levels, and trade with global triggers in mind.

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.

By using this website, you agree to the terms of this disclaimer.

Leave a Reply